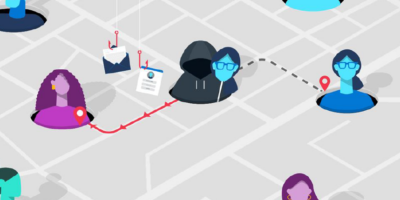

We spoke to PayPal about the significance of the AI-enhanced checkout amid growing cyber threats and fraud cases. Photo: Shutterstock

PayPal uses AI for seamless payment and fraud detection

- An AI-enhanced checkout is significant for PayPal amid growing cyberthreats and fraud cases.

- Data science, machine learning, and AI lead to higher authorization rates.

- They’re also used to ensure a seamless checkout experience for merchants and consumers.

In the world of payments, one of the most important applications of AI is for fraud detection and to speed up payment transactions. With AI, extensive transaction data can be analyzed to identify patterns like timing, frequency, and value–elements that would have been challenging to discern through manual processes.

The reality is that AI has been heavily used and is still being actively adopted by payment companies.

Payment failures are a fact of life in a system like PayPal, and customers tend to accept them as such. But what is happening behind the scenes is far more detailed, with thousands of transactions being dealt with simultaneously and the entire process occurring in seconds.

While it’s not always clear why a payment fails, the result is that merchants lose money when it happens. That is why the emergence of AI within the payments industry cannot be ignored. Machine learning is also a critical application within AI in the payments domain, particularly in high-risk merchant processing.

Phoram Mehta, APAC chief information security officer at PayPal spoke with Tech Wire Asia on how data science, machine learning, and artificial intelligence lead to higher authorization rates to ensure a seamless checkout experience for merchants and consumers. The interview has been edited for length and clarity.

TWA: Why does payment authorization matter to businesses, and what is PayPal’s role in ensuring efficient processes for merchants?

Phoram: In e-commerce, the percentage of transactions that pass through the authorization process is called the authorization rate. A high authorization rate unlocks revenue for online merchants. PayPal plays a pivotal role in ensuring an easy and secure checkout process for consumers while maintaining a high authorization rate, which enhances the likelihood of successful transaction conversions.

In Asia Pacific, the cart abandonment rate is at 79%, surpassing the global average, with a substantial portion of this attributed to payment failures that also, unfortunately, include good customers and payment types. Payment failures are common and can stem from various innocuous factors, including declines due to unsupported payment methods or even human errors, such as insufficient funds in the account or incorrect payment information.

PayPal uses machine learning models and AI to improve the authorization rates of valid transactions by predicting and addressing the issuer declines that interrupt user payment requests. Photo: Shutterstock

On the other hand, the rapid rise of AI is fueling a fraud surge in e-commerce globally, which is predicted to exceed US$48 billion in losses in 2023. As fraud rates escalate alarmingly, robust payment authorization has become crucial to every modern business’s risk management strategy.

TWA: How does PayPal use AI and machine learning in its payment authorization processes? How has this method changed over the years for PayPal?

Phoram Mehta, APAC Chief Information Security Officer at PayPal

Phoram: PayPal uses machine learning models and AI to improve the authorization rates of valid transactions by predicting and addressing the issuer declines that interrupt user payment requests. These cutting-edge technologies have been pivotal to PayPal’s payment authorization strategy over the years and are being leveraged in the following ways:

- Standing in to approve a purchase for customers in good standing

When system outages occur, approving a purchase without processing the transaction immediately is critical for business continuity. In such instances, data science models can help identify good transactions, letting PayPal “stand in” for purchasers and ensure it goes through if technical issues impact any part of the transaction.

- Protecting against fraudulent transactions

Data science allows PayPal to quickly identify fraudulent patterns, such as card cracking & carding attacks, increasingly used techniques by fraudsters where they test a batch of stolen cards on a merchant website to identify valid cards.

- Intelligent retries

PayPal’s machine learning algorithms can help identify the best retry strategy based on the card used, issuer, merchant, transaction-level parameters, processor and acquirer combination, and even the day and time of retry. We can retry a transaction with a token or card number based on success patterns identified by machine learning models.

By analyzing the data, machine learning algorithms can use multiple strategies to determine the best times and methods to retry a payment, and continually reassess. As a result of implementing a smart retry strategy, PayPal has been able to harness an incremental 50 basis point improvement, supplementing the benefits of using a token and intelligent routing.

TWA: How frequently are machine learning models retrained to adapt to changing patterns and fraud tactics?

Phoram: Machine learning models for fraud detection are frequently retrained, even daily, to adapt to changing patterns and tactics. Fraudsters are constantly developing new methods to exploit systems, and it is essential to have a model that can stay one step ahead.

An innovative approach allows Paypal to harness the power of our unique vantage point to enhance fraud detection and ensure the security of our vast user base. Photo: Shutterstock

In the past, training a deep-learning model could take weeks or even months. However, advances in hardware and software have made it possible to train and retrain models much more quickly – essential for fraud mitigation in an ever-evolving threat landscape.

PayPal has a two-sided network of over 430 million active accounts in over 200 markets. Analyzing such complex and highly interconnected data using traditional methods would be a formidable challenge. However, PayPal can employ cutting-edge graph database technology to analyze real-time data and identify fraudulent transactions effectively and efficiently.

TWA: How does AI improve the accuracy of identifying fraudulent transactions on the PayPal platform? What features and attributes are considered by the AI model?

Phoram: PayPal deploys AI-powered filters that harness machine learning to assign a risk score to every transaction, contextualizing each transaction and improving fraud detection accuracy. We do:

- Assessment of customer behavior in real-time: machine learning algorithms run hundreds or even thousands of checks in milliseconds, making it possible to quickly differentiate legitimate transactions from fraudulent ones, helping businesses create a seamless experience for trusted customers.

- Adaptation to changing fraud patterns: with machine learning, businesses can process large datasets with multiple variables and quickly uncover correlations that might indicate more sophisticated fraud attempts.

- Optimization of filters and rules: many fraud tools, including rules-based solutions, use filters. Unfortunately, scammers constantly test filters and design new attacks to circumvent them. Machine learning can provide deeper insights that help businesses customize those filters and rules.

TWA: How does PayPal balance maximizing payment approval rates and minimizing fraud risk through AI?

Phoram: By combining historical trends and transaction variables, PayPal’s machine learning models can help predict in advance if a user’s card will be declined for a transaction and prevent the purchase from being completed. If a decline is expected, PayPal can create a custom experience for the user that will ensure a valid purchase goes through, which has improved authorization rates.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network