By 2028, the data center market is expected to reach US$51.8 billion. (Image by Shutterstock)

The rising cost of building data centers in the APAC

- Singapore is the most expensive place to build data centers in the APAC.

- Singapore has seen an 8% increase in the cost to build data centers.

- Secondary data center markets like Malaysia are benefiting from this.

Given the increasing adoption of AI and other emerging technologies by organizations around the world, the demand for compute power is increasing as well. Be it for running applications, storage or backup, the growth in data has resulted in the need for more data centers.

While the global number of data centers continues to increase, the Asia Pacific region in particular is experiencing growth and demand at a much faster pace than the rest of the world. In 2023 alone, dozens of tech companies and cloud service providers have announced plans to build and operate new data centers in the region over the next few years.

This includes the setting up of new cloud regions and the expansion of data center capacity as well as modernizing legacy data centers. With sustainability a key feature at which most companies are looking today, data center companies are also ensuring their new data centers are built to meet these requirements.

According to a report by Cushman & Wakefield, activity and interest in the region’s data center sector remain strong for investors, developers, and property and operating companies. In 2022, the size of the APAC collocation data center market was US$25.5 billion. By 2028, it is expected to reach US$51.8 billion. Similarly, hyperscale cloud revenue is expected to grow from US$185 billion in 2023 to US$536 billion in 2028.

Silicon Valley has a whopping 688MW of data center capacity in the works.

The report indicated that the regional growth is being driven by several factors. They include:

- Increasingly digitalized population with increasing mobile penetration and a growing adoption of e-commerce and online banking, as well as gaming and streaming content.

- Government-backed digital economy and smart city initiatives such as the transition to cloud computing.

- Improved cable connectivity, especially in cross-sea.

- Increasing AI and machine learning adoption.

- Data sovereignty laws

- The relaxation of data center construction and operation regulations, as well as tax incentives for the sector.

- Geopolitical shifts, especially for emerging markets.

“Asia Pacific accounts for half of the world’s internet users, more than half of the world’s smartphone users and 64% of online sales globally. In India alone, there were 83 billion online transactions from the country’s financial year of 2022 to 2023. As other markets adopt a digital-first approach to banking and business, this domestic demand will continue to unfold across the region,” said Dr. Dominic Brown, head of international research for APAC and EMEA at Cushman & Wakefield.

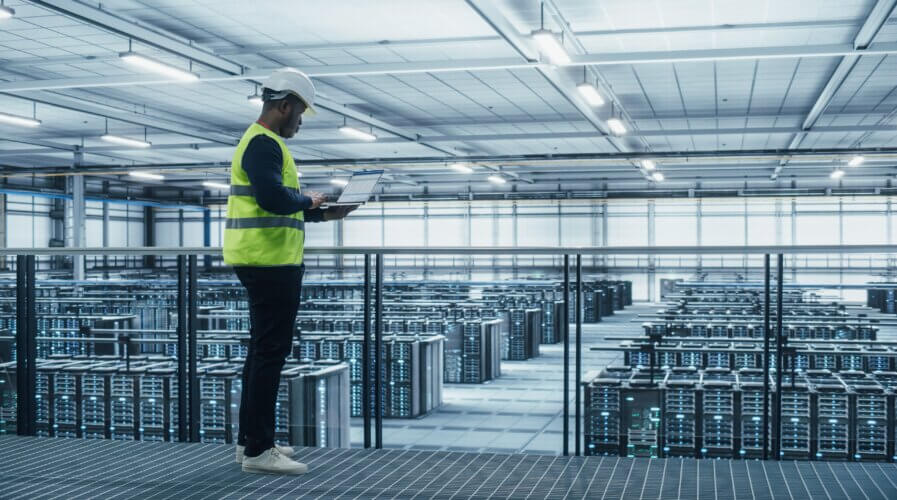

Do we have enough data centers to meet the demand? What about tomorrow’s demand? (Image by Shutterstock)

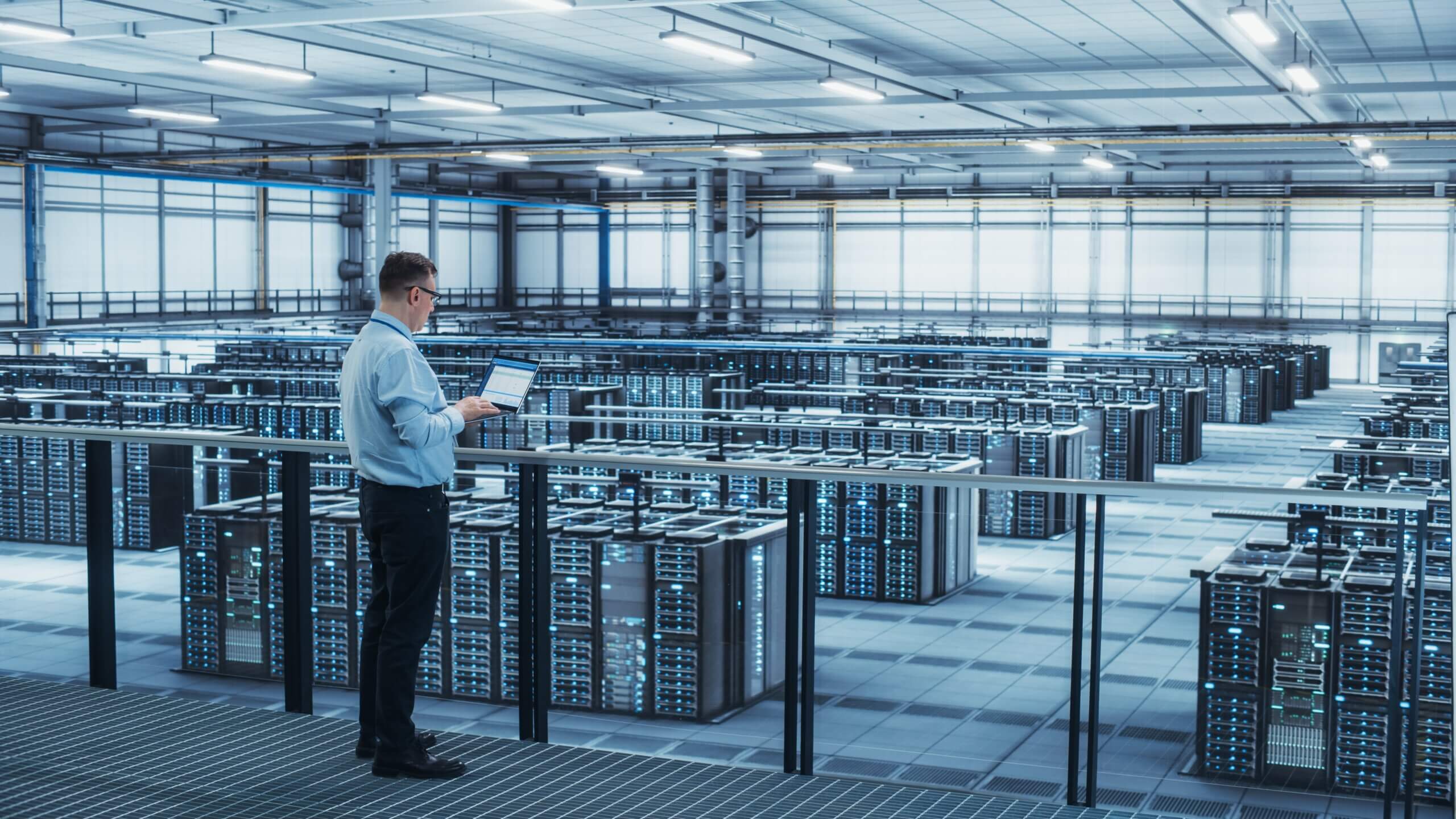

Where to build data centers

While there is increasing interest in building data centers, the challenge now is finding the right place to build them. According to the report, the costs of developing data centers in the Asia Pacific region have also increased in 2023. This is particularly due to the increasing cost of land, as well as raw materials.

Currently, the top five most expensive pieces of land on which you could build data centers are in:

- Singapore

- South Korea

- Hong Kong

- Japan

- Mainland China

When it comes to the cost of building data centers, the top five most expensive regions in terms of construction costs are:

- Japan

- Singapore

- South Korea

- Hong Kong

- Australia

Singapore has seen an 8% increase in the cost of building data centers, while Japan has also experienced a 7.5% increase. In Singapore, the increase in cost is primarily due to the Economic Development Board’s moratorium, which drove competition and interest within the sector and raised energy efficiency and sustainable design standards.

Indonesia is also experiencing a 6.6% increase in costs to build data centers. This is most likely due to operational and development incentives, low pull-through construction costs compared to the wider APAC region, and the disparity between future population needs and the existing capacity.

“Three key trends have driven the increase in construction costs across core markets. Firstly, the number of players entering the market. Secondly, the limited availability of experienced contractors. Lastly, elevated energy and raw material prices along with persistent, though improved, inflation across the supply chain.

“The increasing size of data centers has also driven costs higher, with any economics of scale minimal and easily offset by the higher capacity utilities required for larger developments. With their greater need for space and power, these developments are typically built away from city centers, exacerbating the labor scarcity challenges faced by developers in more metropolitan areas. More remote locations also incur price increases throughout the supply chain as well as in operating costs.

“Adding further strain to the existing supply base, the uptake of AI and ML has created demand for a new network of data centers to be delivered within the next two to three years. Developers have begun to adopt prefabricated construction methods – which can reduce construction timelines between 30% and 50% – to meet this demand; this trend is expected to continue,” explained James B. Normandale, alternative assets lead, Asia Pacific project and development services at Cushman & Wakefield.

Building data centers in primary markets is becoming costlier. (Image by Shutterstock)

The rise of the secondary markets

With land and construction costs increasing, there has been an increase in the construction of data centers in secondary markets around the region. For example, with Singapore almost out of land to build new data centers, organizations are looking to the nearest alternative – Malaysia – to build them.

The Malaysian data center market in particular is one of the fastest-growing in the region right now. There are many factors at work to explain that. However, the two main factors would be the low cost and the ample land space available to build more data centers.

Kuala Lumpur, Selangor and Johor remain the three most preferred areas for data center construction. Johor in particular is popular for data centers to support Singapore, given the state’s close proximity to the island nation. The Iskander region in Johor has witnessed more data centers being built in the last few months. Apart from Malaysia, the report also highlights that cities from both established and emerging markets offer unique opportunities.

“While international players are largely occupied with construction activity in mature markets, secondary markets remain important because of both growing local demand and strategically important locations. Global cloud service providers have planned a presence in Auckland, Bangkok, Busan, Kuala Lumpur, Osaka, Pune and Taipei.

“The tendency for collocation operators, developers and investors to follow cloud service providers into these markets means these secondary markets are likely to experience rapid growth in the coming years,” explained Pritesh Swamy, research & advisor, data centers APAC & EMEA at Cushman & Wakefield.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network