Digital Realty — getting ready for Hong Kong’s cloud-ready

The events of the last six months have certainly not been easy for any outfit. The world’s tech giants — think Dell, IBM, and HPE — have taken (in some cases) drastic measures to curb spend in the face of falling sales.

But while enterprise technology customers are shoring up budgets, demand for cloud services is more rampant than ever. Struck by the overnight need to shift to remote work, businesses have embraced cloud services that have enabled business continuity across a fractured workforce.

This trend won’t reverse: the global digital economy has been pulled forward, and digital transformation for all, expedited.

The upshot, then, is that data-hungry cloud providers across the world are demanding more capacity from data centers, particularly with the increasingly data-hungry demands of applications of emerging technology such as AI, IoT, and 5G.

In the words of Microsoft CEO Satya Nadella, a result of the demands of the pandemic, we saw “two years’ worth of digital transformation in just two months.” And while this is the case for businesses across the world, in Asia — the home of 50% of the world’s internet users — the seismic digital shift has registered highest on the Richter scale.

For the world’s data center leaders, 2020 is a year for decisive expansion in this region. As organizations have, by necessity compressed years-long transformation strategies into weeks-long sprints, data centers have become a vital ‘central nervous system’ in today’s world of business.

Source: Digital Realty

Digital Realty has moved fast to ensure its customers in the Asia Pacific have the critical infrastructure they need. Just months after beginning the construction of its data center facility Digital Seoul 1 (ICN10) in the South Korean capital, the San Francisco-based globetrotter unveiled a new carrier-neutral data center in Hong Kong.

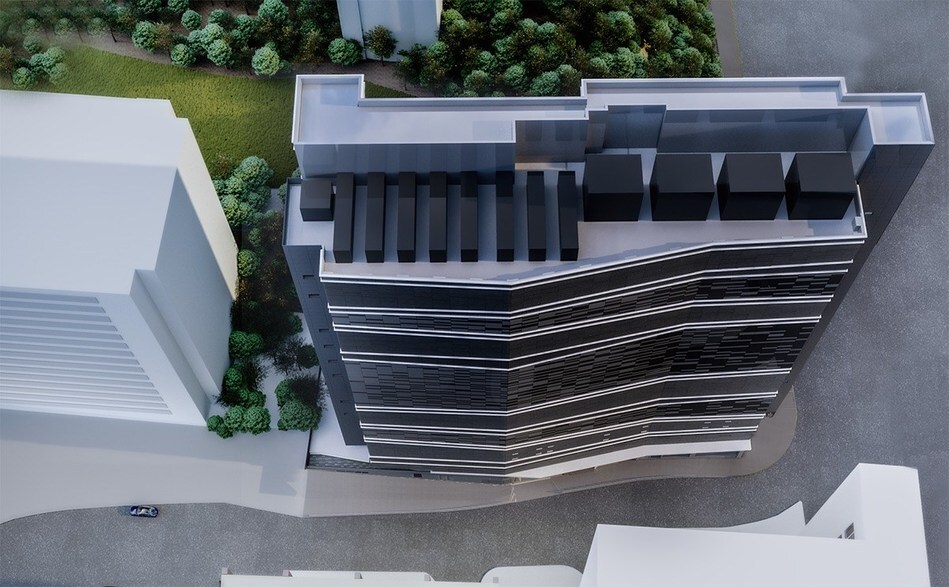

Dubbed Digital Realty Kin Chuen (HKG11), the center will span 21,000 square meters, across 12 floors, delivering 24 megawatts of IT capacity from the heart of Hong Kong’s developing data center cluster, Kwai Chung.

Digital Realty already operates Digital TKO (HKG10), delivering a capacity of 18 megawatts. The new facility is a tribute to the success of that existing footprint, and the firm’s support of Hong Kong’s continued emergence as a world-leading data hub.

The facility is expected to be built out and ready to meet growing demands from global and regional customers by mid-2021.

Having invested in South Korea, Japan, Singapore, and Australia, Hong Kong is a strategic choice for continued expansion. The region has a strong and growing base of customers with an appetite for digital and tops the ranks for cloud-readiness in APAC.

The Hong Kong opportunity

Source: Digital Realty

Indeed, in the 2020 Cloud Readiness Index by the Asia Cloud Computing Association (ACCA), Hong Kong has reemerged as the most cloud-ready state in APAC, claiming the top spot from Singapore.

Hong Kong serves as somewhat of a gateway between China and the West, making it fertile ground for hyperscale cloud platforms from both sides of the gate — such as Amazon Web Services, Google Cloud Platform, Microsoft Azure, Alibaba Cloud, and Tencent Cloud. While political relationships between the two may be at loggerheads, for the agnostic, Hong Kong represents a strategic international business hub, and the data center market has prospered significantly from that.

In terms of infrastructure, too, Hong Kong’s newest data center facility is in the sweet spot. It sits on top of a pre-existing fiber crossroads, so Digital Realty will be able to offer easy access to any of seven different transport fiber options.

According to Structure Research — even without taking into account the impact of the pandemic — Hong Kong’s colocation data center market is expected to double from US$883 million in revenue in 2018 to US$1.7 billion in 2023, well outpacing that of the global market.

But, under the shadows of the cloud giants above, the majority of the colocation market will comprise network and IT services providers, who will contribute 30% of revenue, against the hyperscale sector’s 23%. Either way, it’s manifesting in an ever-greater need for premium data center facilities.

Built ‘on top of’ a Competitive Local Exchange Carrier (CLEC) fiber connection, Digital Realty Kin Chuen (HKG11) promises just that, offering superior digital connectivity to its customers from launch, expected at Q3 2021.

As the data center industry has transitioned from former perceptions as a utility, to one of critical importance today, Digital Realty’s seasoned leadership read the room early and is set to continue building on its current and significant presence across six continents and 21 countries, playing a frontal role in the mechanics of ‘new-normal’ business.

Its APAC conquest doesn’t stop here, either. Heading towards the end of 2020 will see the launch of its SIN12 facility in Singapore, set to become one of the most energy-efficient centers in the city-state, and already partially pre-leased to a major Singaporean multinational banking and financial services corporation, along with a leading global cloud provider.

“Our investment in Hong Kong is another important milestone on our global platform roadmap, enabling customers’ digital transformation strategies while demonstrating our commitment to supporting their future growth on PlatformDIGITAL,” comments Digital Realty chief executive officer A. William Stein.

“As we continue to expand in Asia, the launch of our second facility in Hong Kong underscores its importance as a major data hub, providing customers with the coverage, capacity, and connectivity requirements to support their digital ambitions.”

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network