(Photo by Kirill KUDRYAVTSEV / AFP)

As WhatsApp now allows in-chat payments in Singapore, should e-wallet players be concerned?

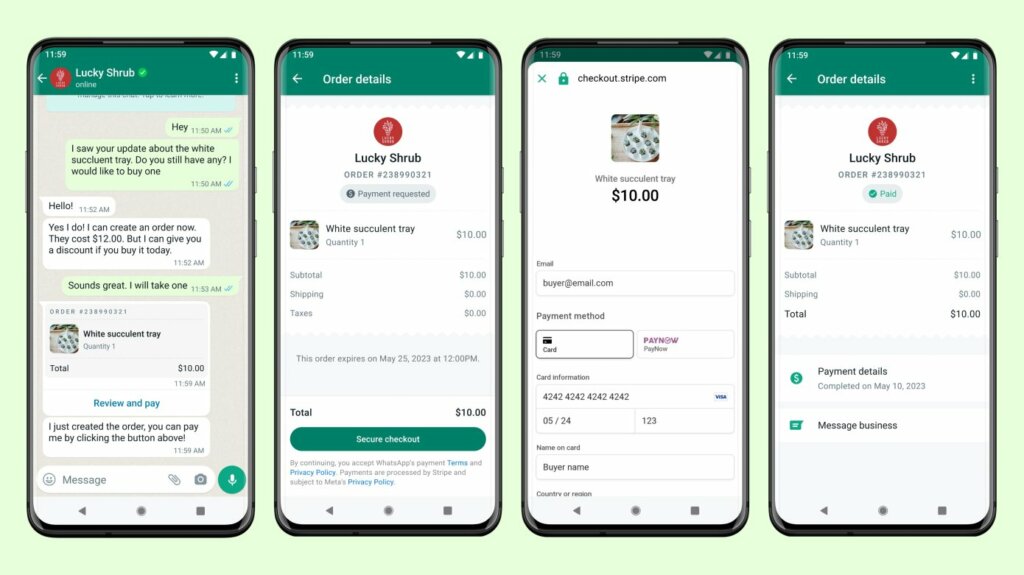

- In collaboration with Stripe, WhatsApp users in Singapore can pay local businesses via a new in-chat feature.

- The option to enable payments on WhatsApp in Singapore is available to local businesses using the WhatsApp Business Platform.

Singapore is now the third country in the world to grant its WhatsApp users an in-chat payments feature, following a collaboration with Stripe, a financial infrastructure platform for businesses. The new feature would allow firms to link a supported payment partner and create an order within the app to accept payments from their customers securely.

Apart from Singapore, WhatsApp’s website shows the payment option is available in Brazil and India as well. The Meta Platforms-owned messaging platform began allowing users in India and Brazil to make payments through its app in 2020. However, the functionality was held up for a year in Brazil after its central bank said it had concerns about the system.

Three years later, Singapore is now granted the same ‘Pay’ option that allows businesses in the city state to accept payments directly in WhatsApp chats. The new feature is built on Stripe Connect and Stripe Checkout, enabling Singapore firms and customers to buy and sell directly in WhatsApp without going to a website, opening another app, or paying in person.

“Supported payment methods include credit and debit cards and PayNow, a real-time payment system popular in Singapore,” Stripe said in a statement. Sarita Singh, regional head and managing director for Stripe Southeast Asia, reckons the speed and convenience of payments through WhatsApp will help businesses expand their revenue streams with new channels and access a broader customer base.

According to Stripe, the option to enable payments on WhatsApp in Singapore is available to local businesses using the WhatsApp Business Platform, which will include a Stripe account. “The feature is currently available to a small number of Singapore-based businesses and will be available to many more in the coming months,” Stripe said.

Source: Stripe

In response to queries from Channel News Asia, WhatsApp said customers who have made a payment would be shown a confirmation screen stating, “Thank you for your payment.” They can also check on the status of their transaction via the “order details” page within the app. There is also no limit to how much a person can pay in a single transaction, with WhatsApp adding that it does not charge fees.

In a separate statement by WhatsApp, this payment feature will be rolled out for more businesses and countries. “Starting today, people in Singapore can pay their local merchants on WhatsApp in just a few taps. This seamless and secure experience will transform how people and businesses in Singapore connect on WhatsApp,” Stephane Kasriel, Head of Fintech at Meta, said.

While it provides the ease of doing business and expands revenue streams, cybersecurity vendor Palo Alto Networks shared that scammers have widely used the service launched earlier in India and Brazil to swindle people of their hard-earned money. “Considering the already escalating volumes and sophistication of financial scams in Singapore, the service may add to the arsenal of threat vectors deployed by scammers,” Palo Alto said in an email statement.

Will the WhatsApp Payment feature disrupt the mobile payments space?

To explain how significant WhatsApp is, the messaging platform alone has over 2.24 billion users monthly, making it one of the most popular global mobile messenger apps. It is also estimated that more than five million businesses worldwide use WhatsApp as of 2019.

That said, bringing in the ease of money transfer while chatting, without even having to skip the window, ultimately elevates the convenience factor. In fact, the simple chatting feature is the edge of WhatsApp Payment over its competitors that seldom extend an interactive feature.

As it is, one of the critical challenges faced by digital payment vendors was getting their app onto their consumer’s smartphones. Take Google Pay, for instance; it took the app two to three years to reach a user base of around 70 million in India. With its built-in user base, WhatsApp has a huge competitive edge over its peers, making markets like India highly competitive.

For a country like Singapore, the new payment feature of WhatsApp can be expected to change how businesses in the city island operate significantly. In fact, allowing companies to conduct transactions on the app eliminates the need for customers to go through the hassle of switching between different apps or payment methods.

That would indirectly fuel competition in Singapore’s e-payment market, dominated by incumbent players such as Grab and local banks. In fact, Singapore currently has about four million e-wallet users, out of a population of 5.7 million. The Asian Banker states that this represents a 70% adoption rate in the country.

Grab has claimed that 77% of overall cashless transactions on the app were performed using GrabPay, and that app usage is 1.3 times higher than the overall cashless usage in Singapore. This dominance could now see a difference if WhatsApp pay gains in popularity among users.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network