The deal has finally been approved by all regulators. (image by Shutterstock)

As the Microsoft-Activision deal is approved, what’s next?

- The now legendary Microsoft-Activision deal is finally approved.

- Microsoft will most likely remain focused on cloud gaming.

- Other gaming brands are hoping to build up their titles as well.

The US$68.7 billion Microsoft-Activision deal is considered to be one of the biggest tech acquisitions in the world. While the deal has finally been completed, with approvals granted from regulators in the UK and the US, many observers are wondering what exactly Microsoft is planning to do with the company now it owns it.

For a start, many felt the Microsoft-Activision deal was part of the tech giant’s plan to take on Meta’s metaverse and Sony’s PlayStation. Microsoft already had the Xbox, but it could never really challenge the PlayStation on that strength alone. Since then, Microsoft has been trying to find a way to make a bigger impact in the gaming industry.

With Activision, Microsoft not only gains the rights to some of the most played games in the world, it can also steer those games toward more development specifically in the Xbox arena.

Activision Blizzard chief executive Bobby Kotick said the two companies had “all the regulatory approvals necessary to close (the deal) and… look forward to bringing joy and connection to even more players around the world.”

The Microsoft-Activision deal finally makes it over the finish line.

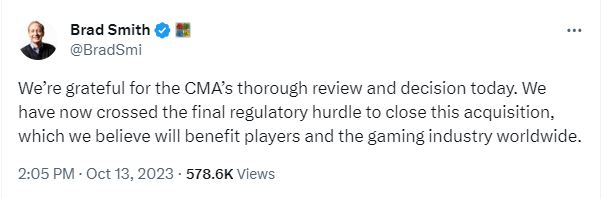

Microsoft vice chair and president, Brad Smith, thanked the CMA for its “thorough review” and approval. “We have now crossed the final regulatory hurdle to close this acquisition, which we believe will benefit players and the gaming industry worldwide,” he added.

According to Will McKeon White, a Forrester senior analyst, with the closure of the deal, Microsoft has assembled an astonishingly wide variety of IP and types of games to bring under the Xbox umbrella.

In addition to traditional popular titles like Call of Duty, Microsoft also gets World of Warcraft, mobile titles like King’s Candy Crush, action platformers like Spyro and Crash Bandicoot, and potentially most importantly, a lot of experience with “live service” titles.

“While there’s growing fatigue/skepticism of the ‘live service model’ in the public gaming sphere, the premise remains fairly straightforward. You still have to compete with all other titles being released, but games that can establish a solid foundation can continuously find ways to retain players and make the effort sustainable for the company.

What I hope Xbox emphasizes next is player-driven innovation, which has spawned many of the most popular franchises and experiences over the past few decades,” said White.

What’s next for Activision’s most popular games? (Image by Shutterstock)

Microsoft-Activision deal: a billion-dollar behemoth

The global gaming industry is projected to be worth US$321 billion by 2026, as stated by PWC’s Global Entertainment and Media Outlook 2022-26 report. The expansion is being driven by social and casual gaming after millions of people picked up their controllers to escape the boredom and isolation of Covid-19 lockdowns.

However, the Microsoft-Activision deal is expected to focus – at least initially – more on cloud gaming. The cloud gaming market is estimated at US$1.69 billion in 2023 and is expected to reach US$6.80 billion by 2028, growing at a CAGR of 32.14% during the forecast period (2023-2028), according to Mordor Intelligence.

Using the power of cloud computing, cloud gaming delivers high-quality gaming experiences to users. This includes utilizing remote servers to process and render games, enabling users to play graphically demanding games without expensive gaming hardware. This technological advancement has elevated the gaming experience by providing access to visually stunning games, smooth gameplay, and reduced loading times.

This is also an area in which Microsoft will be hoping to dominate now that the Activision deal is approved. While several other tech companies are also focusing on this field, Microsoft may now have a significant advantage given the titles it will end up owning. The fear of Microsoft dominating the cloud gaming industry was one of the reasons why the acquisition took some time to get approval.

According to a report by AFP, aside from the concerns over cloud gaming, regulators also worried that the initial deal would have allowed Microsoft to make Activision’s games exclusive to Xbox. Sony, which had previously tried to block the Activision deal, agreed with Microsoft in July to keep releasing Call of Duty on the PlayStation.

Call of Duty is one of Activision Blizzard’s best selling games. (Image by Shutterstock)

Who controls the gaming industry?

While many assume that the Sony PlayStation is dominating the gaming industry, the reality is that China’s Tencent is actually the biggest player in terms of revenue. Tencent Games is already dominating the Asian market and has invested in gaming studios across the world.

Tencent already owns Riot Games, maker of the battle royale hit League of Legends, and has a stake in French game star Ubisoft. It also acquired the Finnish studio Supercell (Clash of Clans, Clash Royale, Brawl Stars) in 2016 for US$8.6 billion — a record at the time.

The other big competitor in the industry is Nintendo. Known for its reliance on self-made sagas such as Mario, Zelda, and Pokemon, Nintendo stands out from its competitors by staying away from the frenzy of acquisitions in the sector. As well as its in-house games, Nintendo also focuses heavily on its Switch console, which has sold more than 100 million units since its release in March 2017.

And then of course there are the other independent players like Sega, Take-Two, Electronic Arts and Ubisoft. All of these companies have produced successful gaming titles and continue to make a profit from them. For example, Take-Two’s Grant Theft Auto remains one of the most popular computer games, while Electronic Arts is known for its sports-focused games.

Sega has also announced plans to acquire Rovio, the creator of Angry Birds in a US$770 million bid. Founded in 2003, Rovio emerged as one of the major success stories from the European technology sphere. The acquisition is yet to be finalized, but could close by the end of Q2 of Rovio’s financial year.

Whether the Microsoft-Activision deal ends up putting Microsoft in the same league as Sony or Tencent remains to be seen – there will need to be some extremely strategic business gameplay to get it there, and the work begins now that the deal is closed.

But one thing is clear – it may not be there yet, but Microsoft just got a great deal closer to that boss-level of the gaming world with the closure of the Activision deal.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network