Workday: Organizations in Asia lag in digital agility and that needs to change(Photo by Mohd RASFAN / AFP)

Workday: Organizations in Asia lag in digital agility and that needs to change — here’s why

- Workday reckons that agility is the foundation that allows for trusted data to be used to increase efficiency, pivot quickly, and achieve goals effectively.

- A Workday study actually found that eight in 10 (79%) organizations in Malaysia are still lagging in digital agility.

Organizational agility, as enterprise software provider Workday puts it, is the ability to react quickly and effectively to what is happening in the market, while continuing to drive innovation across the whole organization. That means that for the long-term survival of any company, the most important thing is its ability to manage the unexpected.

Unfortunately, a recent report from Workday has revealed that the majority of organizations surveyed in Asia Pacific (APAC) still lag in digital agility despite increased technology adoption during the pandemic.

In collaboration with International Data Corporation (IDC), the Digital Agility Index Asia/Pacific 2022 report highlights the extent to which APAC organizations have progressed in digital agility since the Covid-19 pandemic. IDC and Workday surveyed over 800 senior HR, IT, and finance leaders from large-scale companies with more than 1,000 employees from across nine markets in APAC.

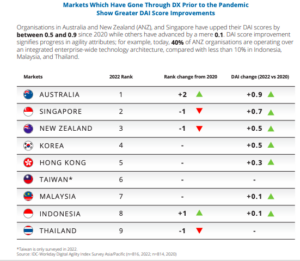

The report highlights that 62% of organizations in APAC lag in digital agility despite increased technology adoption during the pandemic and only 38% of organizations are in the advanced stages of digital agility. While organizations in Australia achieved the greatest progress in digital transformation efforts and has ranked first this year, the study noted that eight in ten (79%) organizations in Malaysia are still lagging in digital agility.

Singapore, which ranked first in 2020, dropped to second position, followed by New Zealand, Korea, and Hong Kong, the survey indicated. Meanwhile, Taiwan, a new addition to the study, ranked sixth whilst Indonesia ranked eighth, followed by Thailand. Overall, across all the nine Asia markets surveyed, progress in digital agility has been uneven.

IDC-Workday Digital Agility Index Asia/Pacific 2022.

In conjunction with that report and the rising prominence of digital agility in today’s business landscape, Tech Wire Asia had the opportunity to speak to Lee Thong Tan, CFO Practice Lead, Asia, Workday. The conversation revolved around why organizations need to urgently embrace digital agility if they want to survive and thrive amidst the current economic uncertainty and anticipate economic slowdown.

How would you define business agility in a post pandemic era?

With all the uncertainty, businesses must be able to pivot while being better equipped to manage their costs and optimize their cash flow. Organizations will also need to identify emerging opportunities like new revenue streams, new products, new market segments, and at the same time, minimize their risks. To be agile is about being able to navigate circumstances quickly.

Having insight of what is currently happening is not enough. Businesses need to plan ahead. This means having the resources to do scenario planning for situations ranging from a return of lockdowns to skyrocketing inflation – to be able to cost correct and forecast accurately and accordingly.

When we look into Malaysia specifically, despite increased tech adoption, what do you reckon organizations are still lacking when it comes to digital agility?

The Digital Agility Index has shown that Malaysia has been generally slow to pivot towards digital transformation despite increased technology use during the pandemic. The study has also found that the lack of skills involved in both talent acquisition and talent retention are among the top challenges faced by organizations in Malaysia in pursuing digital transformation.

Our study also found that 63% of finance leaders in Malaysia highlighted challenges in identifying new growth opportunities while driving profitable revenue growth in this rapidly changing business environment.

Earlier, I mentioned that there has been increased technology use due to the pandemic. But why does this not lead to increased digital agility? What we found was that companies had been investing heavily in increasing the use of technology on front end operations. However, when it comes to the back end, such as when exploring finance and HR systems, we discover that the implementation of technology is still lacking. This causes a digital disconnect in organizations as the technology used by front end operations do not correspond with back end operations, resulting in organizations still lagging in digital agility.

Companies that are agile have, for example, pivoted towards enterprise cloud solutions. Such solutions will allow businesses to have both a better visibility of financial and human capital capabilities. Business leaders will then be better placed to make more insightful decisions with the relevant data collated and centralized accordingly. This consequently will allow them to make quicker decisions and make business pivots where needed.

For example, we worked with AON and Netflix to futureproof their businesses when we accelerated their transition towards the adoption of cloud solutions. This allowed the businesses to transform financially with improved yet secured access to key relevant information, improving overall business agility and efficiency.

What sort of company or industry is better at transforming their businesses to be more agile?

There are a lot of factors that can affect business agility. It all boils down to being equipped for organizational readiness. It also doesn’t matter whether the organization is part of the public or private sector because it all depends on how much they are willing to transform. However, we do note that organizations in construction are relatively slower in being digitally agile as compared to companies offering technology or professional services. Nonetheless, such brick-and-mortar businesses are also moving quickly to pivot to retain and attract talent.

While we observe that banks, financial services, and insurance companies going big on digital approaches, we also note that they have invested a lot on front end operations and are now looking at securing back end processes to keep up with fast-paced challenges.

Would you reckon that Malaysia is on its right path towards transforming their companies?

The topic of digital transformation was front of mind for CFOs of Malaysian companies at a recent CFO symposium in Kuala Lumpur which I participated in. In addition, discussion on skill sets – especially on issues of upskilling and reskilling were constantly mentioned too. These observations hence reflect the mindsets of many other business leaders in the country.

What are the specific tools or technology that you think can directly facilitate business agility?

For businesses to be agile, they will need to have full business insight into what currently is happening and what to expect going forward. It is therefore really important that businesses build and have a good, intelligent data foundation. This will allow business leaders to make informed decisions based on real-time data to best respond to macroeconomic situations.

But what we are seeing today with many companies is that data is not centralized. There are different formats and systems, and they are not working in tandem with one another. This then evolves into a situation where data cleansing and data reconciling is needed, and the element of trust in a company comes in to question. Put simply, we need to not only build an intelligent data system but ensure that it is consolidated and centralized to run accurate financial processes accordingly. For example, we worked with Netflix to consolidate 11 systems into one for accurate streamlining of operations.

Technology and data will also need to be packaged to be user friendly enough to be used anywhere, anytime, and across multiple devices. Workday’s approach towards the democratization of data allows business users to access the relevant data in real time and make the relevant decisions on one centralized platform.

As such, to be agile, in my opinion, will be when the relevant stakeholders have the access to the data that they need and when they require to make the most timely and informed decisions.

Today, data is considered a commodity in today’s day and age. How would you reckon organizations in the region are or should be managing their data?

In Singapore and Malaysia, in the finance and accounting associations, there is a lot which goes into continuous education that does deep dives into analytics to equip our finance professionals with the necessary skills to best use data for financial analyses. However, what is most important is also ensuring that professionals have access to the right cloud technologies and software providers that can provide a good platform to build good and intelligent data models.

By relying on the right and relevant technologies, organizations will be better able to lean on technologies like AI and machine learning and better manage and leverage their use of data.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network