The need for speed: how banking tech builds have accelerated

The emergence of digital technology has brought significant changes to the banking industry. Customers now expect convenient and seamless digital experiences in their banking services. However, most banks are facing challenges in digitizing their services, which hinders their progress.

The biggest challenge is often dealing with legacy systems and infrastructure. These outdated systems can no longer handle the speed, scale, and complexity required today. Hence, banks will be looking to replace or upgrade these systems – a costly, time-consuming, and risky process if not planned and implemented properly.

In fact, any fundamental change or upgrade to these systems in the past would typically take at least six months to a year, but likely more. In turn, this would lead to increasing costs as well as the risk of operational challenges. Banks had no choice but to endure this lengthy process.

Today, the process of implementing changes to a bank’s core environment has changed significantly and financial institutions are benefiting from new approaches that result in reduced cost and required effort. Banks can easily build, test and run new applications in weeks.

According to Dr. Christoph Market, Head of Architecture for SAP Fioneer, in the past, a lot of the technology used by banks was proprietary and not pre-packaged. There was a limited set of standards and banks did not really have a plug-and-play concept.

“When we look at implementation costs, it’s mostly driven by time. If you blow out your timeline, it is very likely your costs will increase. A fundamental objective for banks was reducing implementation and integration timelines. In the past, you needed to start from scratch. There were no pre-set accelerators available. Pre-configured business capabilities only gained acceptance by the industry when cloud services became increasingly adopted. The cloud allowed faster deployments in more environments and was a big time saver that saved cost, especially with its implementation speed,” said Dr. Markert.

Cloud and banking

Cloud services enabled the IT department of banks to evolve into a commoditized service centre powered by cost efficiency, agility, innovation, collaboration, security and improved customer services. With proper planning, implementation and management, packaged business capabilities deployed in the cloud can be a game-changer for banks to modernize their legacy core applications. That modernization enables the acceleration of digital transformation and delivers individualized and value-adding services to customers.

When it comes to the cloud for banking, SAP Fioneer recommends a two-platform architecture for the overall core. By developing this model, banks can deploy specific applications for differentiation rapidly. As well as not impacting the core’s codebase, they can also benefit from continuous innovations provided to them by their vendor.

Apart from the cloud, other drivers that have revolutionized how banks build and deploy new applications include their architectural and deployment style. Two decades ago, banks would need to take a big bang approach to deploy new products that were hosted on-premise. This process was lengthy and often lead to increased costs.

In the 2010s, banks could deploy new products on a ‘parallel run’ basis on platforms hosted on commodity hardware. While this method reduced deployment time, it primarily leveraged a service-oriented architecture approach, meaning there was still a need for some building by the banks and integration it into the end-to-end system landscape.

By 2020, advancements in technology had enabled banks to offer new on a ‘sidecar SaaS’ basis. Sidecars represent packaged business capabilities deployed next to an existing system landscape. A sidecar is typically capable of running independently from a bank’s existing system landscape with only minor integration pointing towards it.

In comparison, a ’parallel run option’ still has major integration touchpoints with existing systems, representing one of the fundamental differences between the two approaches. Cloud hosting has reduced dramatically the time required to build and deploy new products, allowing banks to focus more on feature development.

The graph below from SAP and SAP Fioneer data since 2000 illustrates how deployment time and costs have fallen in the past two decades.

Source: SAP & SAP Fioneer data

Reducing costs and time to deploy

There are three key areas banks need to look into that will help them reduce the cost and time needed to build and deploy new applications for their customers.

First, when it comes to core banking, being able to react to ever-changing business requirements in an agile, rapid and operationally non-disruptive way is a key differentiator. Structurally, this means a separation between the core processes and capabilities for standardized business offerings (e.g. everyday banking accounts, mortgages, etc.) and those residing on a cloud-based platform. That structure enables market differentiators, like personalized pricing for individual customers, for example.

Next, banks need to be able to separate banking components into packaged capabilities with connectivity to the core and other parts of the broader ecosystem. This opens the possibility for combining modules together for rapid expansion OR integration with third-party services allowing a bank to rapidly extend its offering.

Thirdly, it’s about having standard key banking components. For commoditized services like onboarding, know your customer (KYC), lending, and such, banks should not have to reinvent or build from scratch but instead rely on pre-configured, end-to-end products that can get them up and running with new or improved offerings very quickly.

For example, SME banking may be an area a financial institution might want to expand into. However, it might lack the technical capabilities to realize such a growth strategy quickly without invasive and disruptive changes to its existing IT platform. With SAP Fioneer, banks can have a full SME banking solution that allows them to easily deploy on a “plug and play” basis.

Building blocks of banking

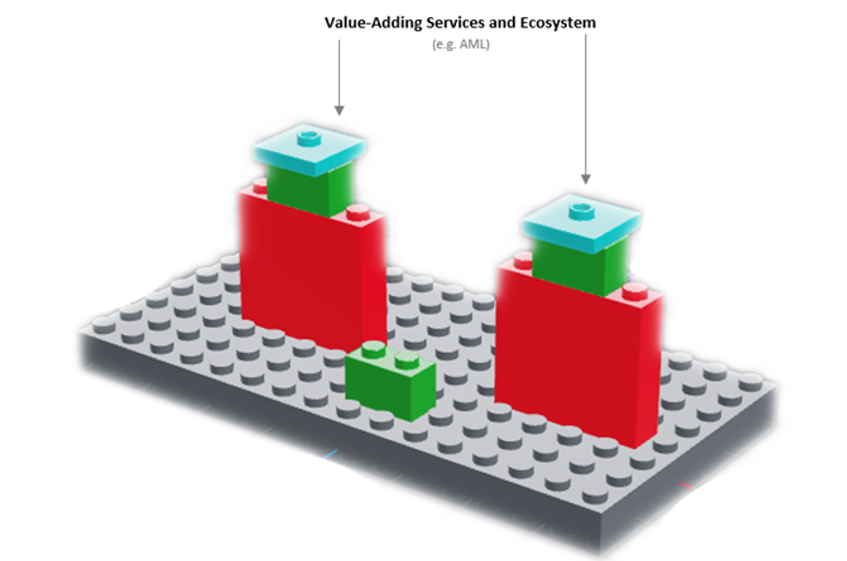

Dr. Markert explains that this entire process is like building a platform with Lego blocks. For example, banks have options for which hyperscalers they want to use. The base plate of the Lego represents these hyperscalers.

Source: SAP Fioneer

When banks want to launch a new product like SME banking, they plant a packaged business capability with pre-configured content onto the platform.

“All of these platforms already have a base that SAP Fioneer supports. Banks just need to plug into it. For example, when it comes to SME banking, they just need to plug pre-configured content onto the platform. It will be easily deployed via packaged business capabilities. Banks do not need to spend time building these models and capabilities from scratch,” explained Dr. Markert.

Source: SAP Fioneer

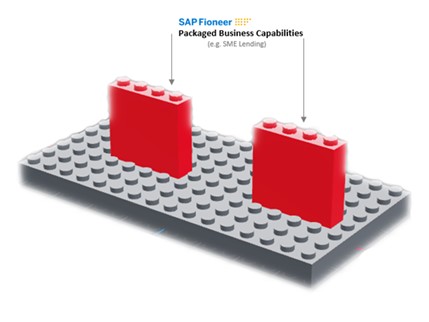

Dr. Markert said APIs sit on top of the packaged business capabilities so they can be easily integrated into the broader ecosystem of a bank.

Source: SAP Fioneer

These APIs provide the connectivity towards a broader set of value-adding services, which may be required to build and realize the overall end-to-end process of a service offering such as AML or KYC. This concept enables financial institutions to focus on, invest in and build out their innovation and differentiation capabilities for competitive advantages – such as personalized pricing, a one-minute onboarding experience or an AI-powered banking concierge service.

Source: SAP Fioneer

Dr. Markert also highlighted that not all APIs provide access to and from packaged business capabilities as some may already come directly from the cloud provider’s platform.

“We are now down to three months to roll out any current account, banking product with a card, or simple lending products. Twenty years ago, this would not have been possible and would have required a lot more time and work. You don’t have to build from scratch anymore and this saves a lot of time, cost, and mitigates risks as well. Combining this architecture with a side-car approach, limits the amount of change required to your existing system landscape significantly, whilst accelerating your deployment.,” added Dr. Markert.

Why does speed and deployment methodology matter?

As Markert points out, faster deployment means less cost, obviously. But more than that, if you compartmentalize new development, you reduce risk, caused, for instance, by operational issues in existing systems. And more importantly, you release funding and resource to where it’s needed for a competitive edge. That gives banks the room to develop new products and features that differentiate them in the market, and a way of getting those new products and features to their customers quickly.

To find out more about SAP Fioneer’s composable, cloud-based banking solutions, click here.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Transformed Finance and Automated Excellence with Trintech

- Why focused software makes the difference in the AEC industries

- Building trust in the data economy: Enerlyf and Affinidi redefine CX, privacy and energy efficiency