Shein considered a US IPO for three years but faced obstacles amid Beijing-Washington tensions. (Photo by Yuichi YAMAZAKI / AFP).

Did Shein finally make the bold move and file for a US IPO?

- Shein considered a US IPO for three years but faced obstacles amid Beijing-Washington tensions.

- This week, the fast fashion giant filed for a 2024 IPO without specifying the deal size or valuation.

- Shein spent US$1.28 million on Capitol Hill lobbying this year and held private meetings with lawmakers, including critics, to improve its reputation in Washington.

Chinese fast fashion giant Shein has had quite the jounrey, from China to its current headquarters in Singapore, and in its latest evolution, aiming to file a US IPPO.

Founded by Chinese entrepreneur Chris Xu, within a decade of its inception, the company achieved a valuation of US$100 billion during an April 2022 fundraising round – a value higher than Zara’s owner Inditex and H&M combined. By 2022, Shein was the world’s third most valuable startup.

Fast forward to this week, when the fast fashion giant confidentially filed to go public in the US, one of its largest markets.

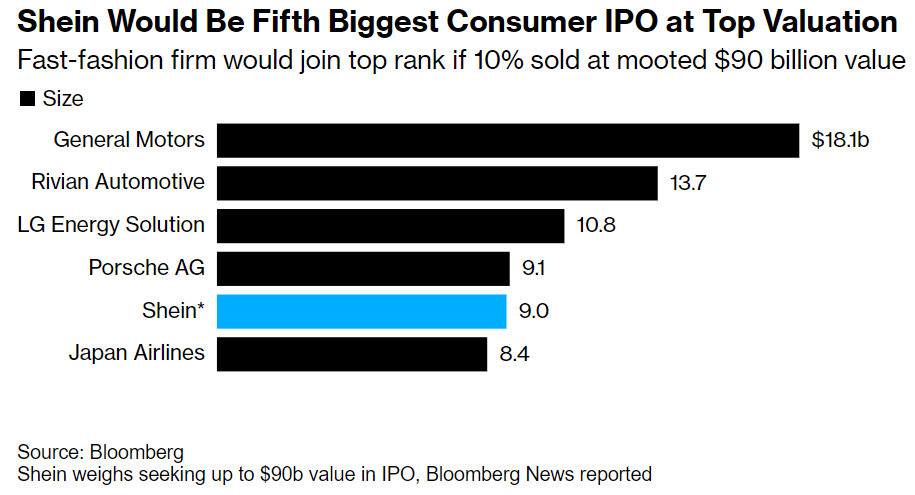

In May this year, the company experienced a valuation dip to slightly over US$60 billion, but if it goes ahead with its initial public offering (IPO), Shein is still on course to emerge as the most valuable China-founded company to go public in the US. So far, only Didi Global, the Uber of China, has come close, delivering one of the year’s biggest IPOs in 2021, at a US$68 billion valuation.

Shein faces the formidable task of convincingly assuring skeptical investors, politicians, and regulators that the controversies surrounding the company do not pose an impediment to its growth.

Still, the move to discreetly file for an IPO in the market from which it receives the most scrutiny is being seen as an audacious move by Shein. Around the world, the company has faced scrutiny for issues including reported subpar working conditions in factories, alleged copyright infringement concerning independent artists’ designs, and criticism of the environmental impact associated with fast fashion. Shein, however, has consistently refuted these accusations.

In the US specifically, Shein is under constant, ongoing scrutiny – no matter what it does to stay on the good side of US lawmakers. Most recently, Shein and its rival Temu were accused of “building empires” by a US House committee in a report on firms exploiting legislative loopholes to evade US import taxes and sanctions checks.

Other concerns raised by critics center around the possibility that Shein might engage contract manufacturers located in China’s Xinjiang region, where advocates and governments have made allegations of the internment of Uighurs and other predominantly Muslim minority groups. Beijing, however, denies any such abuses.

Shein and its lobbying effort for its US IPO

Persuading regulators about the integrity of its supply chain is expected to be a significant regulatory hurdle for Shein as it seeks approval from the US Securities and Exchange Commission (SEC) for its IPO. Earlier this year, a bipartisan effort led by a congresswoman urged the SEC to postpone Shein’s IPO until the company’s supply chain could be verified free from forced labor.

A man cleans the windows of the first permanent showroom of Chinese online fast fashion giant Shein in Tokyo. (Photo by Richard A. Brooks / AFP).

Additionally, a coalition of Republican attorneys general from 16 US states has called for an SEC audit of Shein. The company has faced scrutiny from two separate Congressional committees for its sourcing practices and utilization of a trade loophole that lets most of its products into the US duty-free.

In its latest social impact report, Shein emphasized its collaboration with Oritain, a firm employed by the US government to examine cotton connections to China’s Xinjiang region. As previously disclosed to Reuters, Shein conducts tests on samples from every third-party cotton mill with which it collaborates. Between June 1, 2022, and July 11, 2023, the company conducted 2,111 tests.

Nevertheless, critics argue that the testing procedures fail to adequately scrutinize the millions of garments Shein exports worldwide each year. A separate Reuters report noted that Shein allocated US$1.28 million for Capitol Hill lobbying this year in anticipation of its public debut. The company also engaged in private meetings with lawmakers, including prominent critics, aiming to reshape its image in Washington, as per insights from Congressional aides.

In addressing concerns about its supply chain, Shein representatives underscored the company’s commitment to diversifying its sourcing from China to include other nations, notably India. They also highlighted the company’s efforts to increase the number of Chinese goods coming to the US via conventional container shipping, acknowledging the payment of tariffs on these items.

“Shein is fundamentally a Chinese company; investors should approach Chinese offerings with extreme caution. Its attempt to go public should prompt a closer look at its business practices, especially its links to slave labor and its evasion of US customs laws,” Republican Sen. Marco Rubio told Reuters. “I will closely monitor Shein’s disclosures in the lead-up to its IPO,” added Rubio, who criticized the retailer’s lobbying efforts in a letter distributed to other senators in June.

The Wall Street Journal, the first to break the news on Shein’s IPO, said that Goldman Sachs, JPMorgan Chase, and Morgan Stanley have been hired as lead underwriters on the offering, which could happen in 2024.

How will Beijing treat Shein’s US IPO?

Since a broad crackdown on overseas listings, fewer Chinese IPOs have been in the US. As part of Shein’s ongoing efforts to prepare for its inaugural share sale in the US, the company strategically positions itself as a global entity despite its Chinese origins. It started in 2022 when Shein relocated its headquarters to Singapore and initiated the expansion of manufacturing facilities beyond its Chinese base.

The e-commerce giant eventually established distribution centers in the US, Canada, and Europe to enhance shipping efficiency in these regions. Notably, the company acquired the British online brand Missguided in October and secured a stake in the fashion retailer Forever 21 owner in August.

A Shein pop-up store in Paris. (Photo by Christophe ARCHAMBAULT / AFP)

There remains the possibility that Chinese regulators will subject Shein’s listing to scrutiny and mandate the company to seek approval. After all, Chinese securities regulations necessitate companies to register for the sale of shares abroad, subjecting them to screening for state security and other potential concerns. Such regulatory processes could introduce further delays to Shein’s IPO proceedings.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network