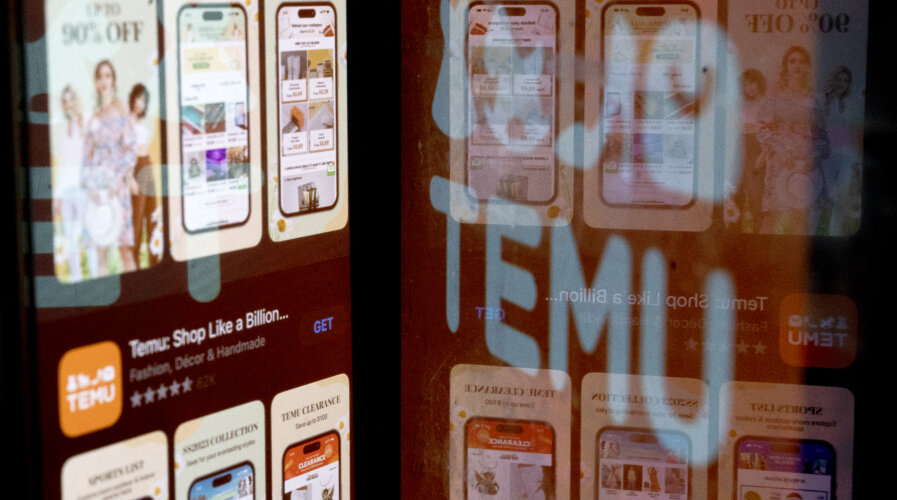

Temu went all out during the recent US Super Bowl, airing its ad six times and giving away US$10 million in prizes. (Photo by Stefani Reynolds / AFP)

Is Temu’s Super Bowl splurge a last-ditch effort amid fading US interest?

- Temu went all out during the recent US Super Bowl, airing its ad six times and giving away US$10 million in prizes.

- Searches surged during ads but have declined steadily since July 2023.

- Data from Morgan Stanley shows 1/3 plan to shop less on Temu in the next three months.

In a typical e-commerce landscape where competition is fierce and attention spans are fleeting, companies are constantly seeking innovative ways to remain top-of-mind for consumers. Temu, a Chinese fast-fashion giant backed by Nasdaq-listed PDD Holdings, has recently made headlines with a surprising tactic: splurging on Super Bowl ads in the US. This move has sparked curiosity and speculation about Temu’s position in the US market and its strategy for staying relevant in an ever-evolving industry.

In the fast-paced world of e-commerce in the US, two giants have emerged as frontrunners in the battle for consumer attention: Temu and Shein. Their sleek interfaces, vast product offerings, and attractive deals have captured the hearts—and wallets—of millions of shoppers across America. But competition is also peaking, and Temu has been facing increasing pressure, especially from Shein.

The fast-growing Chinese e-commerce platform has to protect its market share from being constantly eroded. Temu has been forced to reevaluate its approach to maintaining relevance in the fiercely competitive US market. Last weekend, Temu splashed at the Super Bowl, airing its ad six times and dishing out a jaw-dropping US$10 million in giveaways, all in a bid to breathe new life into its waning US presence.

The Super Bowl is an event known not only for its electrifying football showdown but also for its highly coveted advertising slots. A 30-second commercial during Sunday night’s game cost about US$7 million. With millions of viewers tuned in from around the world, the Super Bowl presents an unparalleled opportunity for brands to showcase their products and capture the attention of a captive audience.

Source: X.com

Temu’s American shopping base is dwindling, with Second Measure data showing a decline. A late January Morgan Stanley survey revealed nearly a third of users plan to decrease app usage over three months, with only eBay and Etsy showing weaker forecasts. Sales took a nosedive for Temu, plummeting 12.5% in December and 4.8% in January, a stark contrast to its 50% growth in mid-2023. Despite Temu’s struggle, overall US retail sales surged in December.

For Temu, this year’s Super Bowl represented more than just a chance to advertise its latest gadgets—it’s a strategic move to reclaim its position as a frontrunner in the tech industry. These insights, drawn from Bloomberg’s Second Measure data track a slice of US credit and debit card transactions.

But why the sudden emphasis on splashy advertising, especially in an era dominated by digital marketing and social media influencers? The answer lies in Temu’s recognition of the power of storytelling and emotional connection in shaping consumer perceptions. By investing in high-profile ad placements during one of the most-watched events of the year, Temu aims to create memorable experiences that resonate with audiences long after the final whistle blows.

Temu’s decision to splurge on Super Bowl ads is not without risks. With advertising costs reaching new heights, there’s no guarantee that the investment will yield the desired returns. The company faces fierce competition from other tech giants vying for the spotlight during the big game. While web searches for the app spiked when its ads aired, according to Google Trends data, searches have steadily declined since early July 2023.

Overall, Temu, which made it into the US market in September 2022, spent a staggering US$3 billion last year on marketing, per Bernstein Research. And if its Super Bowl campaign is any indication, it’s not pumping the brakes anytime soon. The spending spree underscores the challenge ahead: Temu aims to attain prominence in the West that has eluded most Chinese-owned enterprises, with only Shein and TikTok managing to carve out substantial niches thus far.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network