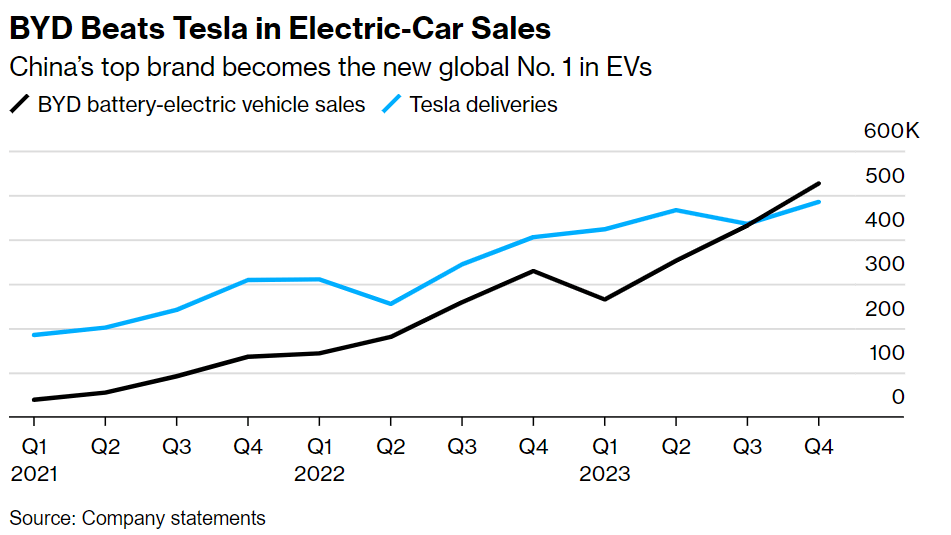

BYD reported selling more than 526,000 fully EVs in the fourth quarter of 2023. (Photo by CHRISTOF STACHE/AFP).

Tesla falls short: BYD surges to the top in global EV sales for the first time

- BYD reported selling more than 526,000 fully EVs in the fourth quarter of 2023.

- Tesla meanswhile sold nearly 485,000 during the same period.

- Across the whole of 2023, Tesla still sold more cars than BYD, albeit at a slower rate than before.

In a groundbreaking turn of events, Chinese automaker BYD has outpaced Tesla, emerging as the top global electric vehicle (EV) seller for the final quarter of 2023. This pivotal achievement highlights the ascent of China’s influence and dominance in the worldwide market for battery-powered cars. The two titans have been in a battle for supremacy, especially in terms of the number of vehicles delivered.

Despite exceeding analysts’ expectations with 484,507 vehicle deliveries, Tesla found itself trailing behind BYD, which clinched the top spot with an impressive 526,409 fully EVs sold in the last three months of 2023. The surge in BYD’s sales can be attributed to its diverse array of more affordable models, strategically positioning the company as a leader in the rapidly expanding Chinese EV market.

In short, the last quarter signifies the inaugural period where BYD’s battery-only sales have eclipsed Tesla’s. According to an exchange filing Monday, China’s best-selling car brand reported EV and hybrid sales of 340,178 in December — including 190,754 all-EVs — aided by aggressive end-of-year discounting. In total, BYD sold 3.01 million units in 2023.

BYD has sold enough cars to overtake Tesla for the first time on a quarterly basis to become the world’s biggest seller of fully electric EVs. Source: Bloomberg.

In a statement published in China, the Shenzhen-based group called itself the “world champion” for “new energy vehicles.” On the other hand, Tesla has encountered a deceleration in demand amid rising borrowing costs. Nevertheless, when considering 2023 as a whole, Tesla still maintained higher overall sales.

The EV giant made approximately 1.81 million EV deliveries worldwide in 2023, met its annual targets, and exceeded Wall Street’s expectations. However, the 38% growth from the previous year signals a moderated expansion pace and tighter profit margins in an increasingly competitive landscape.

“After the chief executive officer (Elon Musk) told analysts the company had the potential to produce 2 million cars, a series of price cuts failed to stoke enough demand to support that much output,” Bloomberg reports.

In stark contrast, BYD experienced a remarkable surge, selling nearly 1.6 million battery-powered vehicles in 2023, representing a 70% increase over the previous year. As the competition between Tesla and BYD intensifies, industry observers and enthusiasts are keenly watching each move these giants make.

While Tesla retains its reputation for innovation and premium EVs, BYD’s success in delivering a broader range of budget-friendly options highlights the evolving dynamics of consumer preferences and market demands.

“Tesla generates more revenue and profit than BYD because it sells much higher-priced vehicles and relies on just two models for the lion’s share of its sales. The Model Y sport utility vehicle and Model 3 sedan accounted for 95% of deliveries in the fourth quarter,” said Bloomberg.

While BYD holds a robust market presence in its native China, it has yet to enter the US market due to the country imposing 27.5% import tariff and other associated challenges. Despite this, BYD is on a global expansion trajectory, setting its sights on markets such as Europe. In contrast, Tesla, a formidable player in both the US and Chinese markets, manufactures its Model S, X, 3, and Y in Fremont, California, and produces the Model 3 and Y in Shanghai.

Will 2024 be the year that sees BYD go global?

Tesla has further diversified its production with facilities in Austin and outside Berlin, where it manufactures the Model Y, demonstrating its commitment to a geographically varied manufacturing footprint. In the last year, BYD persisted in its global expansion strategy, and recently opted for Hungary as its European production hub.

The chosen location for the inaugural production line on the continent is the southern city of Szeged. BYD aims to manufacture EVs and plug-in hybrids tailored for the European market, a move anticipated to generate thousands of jobs. Notably, this decision unfolded amid an ongoing European Union anti-subsidy investigation into Chinese EVs, underscoring BYD’s commitment to its expansion despite regulatory scrutiny.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network