AirAsia and Foodpanda consolidate in food delivery and e-hailing services. Here’s how it works nowSource:AirAsia

Watch out Grab! AirAsia and Foodpanda consolidate to partner in food delivery and e-hailing services

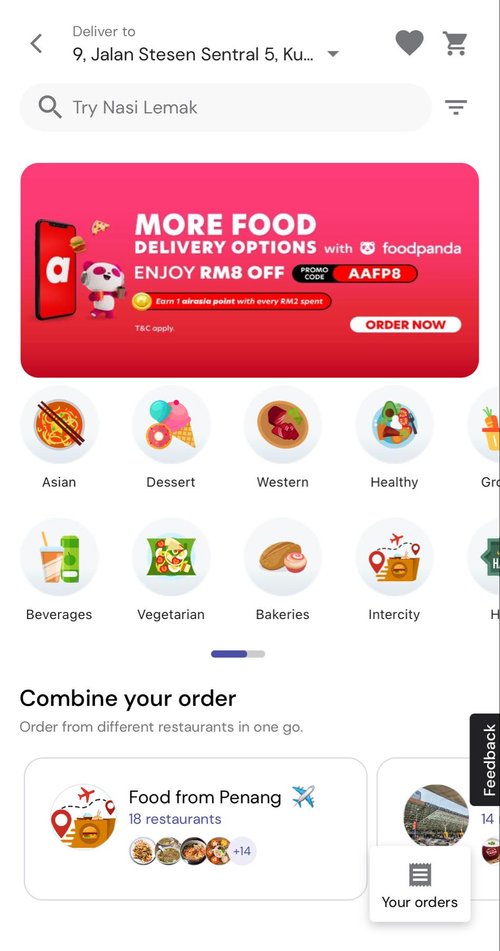

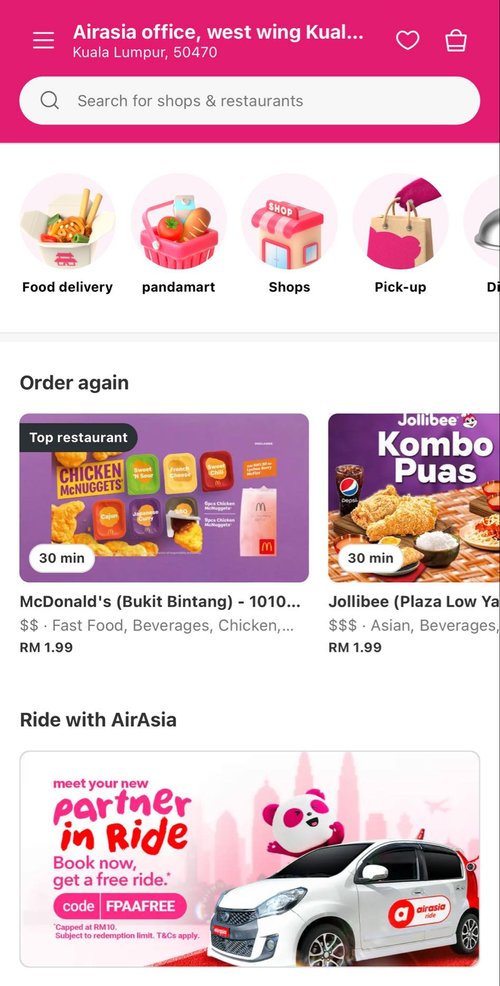

- The strategic partnership resulted in AirAsia’s ride-hailing service and AirAsia ride being made available on the Foodpanda app.

- In turn, Foodpanda will be powering AirAsia’s food delivery service.

- The consolidation is so far applicable in Malaysia, with the rest of the region expected to follow suit in the coming months.

Not too long after AirAsia unveiled its new identity as Asean’s superapp in October 2020, the Malaysian budget airline revealed that it’d be biting into the food delivery industry too. A month later, AirAsia food was launched in Malaysia and, by 2022, across the ASEAN region. The move was audacious considering the industry’s stiff competition, but AirAsia was unperturbed.

When the Malaysian budget airline launched its food delivery services, AirAsia threw the gauntlet at its rivals, saying it would charge a 15% commission rate for all its merchants. That’s lower than the commission charged by the Big Three — GrabFood, Foodpanda, and Deliveroo.

Time passed, and AirAsia eventually realized that it could do better with its superapp’s food delivery services, and sure enough, synergies were on the cards. Last week, the superapp announced that it has partnered with Foodpanda to consolidate its food delivery and e-hailing services – an expected move but by a rather unexpected pair.

CEO of Capital A, the holding company of the superapp, Tony Fernandes, said the ‘strategic partnership enables both platforms to leverage each other’s strengths, to offer better value and greater convenience to users across Asean and beyond.

That means that since the announcement on May 12, AirAsia superapp’s ride-hailing service and AirAsia ride have been made available on the Foodpanda app. On the other hand, foodpanda – the largest on-demand food and grocery delivery service in Asia outside China – have started powering the superapp’s food delivery service.\

The partnership will allow millions of Airasia superapp users to connect to Foodpanda’s extensive network of more than 100,000 merchants and thousands of delivery partners.

“This platform partnership will enable us to leverage each other’s strengths – food panda’s food & grocery delivery prowess and our ride-hailing services backed by a complete travel superapp ecosystem, both a necessity for travelers and everyday users of both apps alike,” Fernandes said in a statement.

He further hinted that there is so much potential that AirAsia superapp and Foodpanda can further explore together, such as payment solutions via BigPay, joint loyalty programs with Airasia rewards, possible subscription plans, and more.

Because food is not a forte

When Fernandes was asked to explain AirAsia’s move to hand over their food delivery portfolio to Foodpanda, he explained, “During Covid, we were trying to look at how we are going to survive, and so we developed a very powerful airline app, which is what we now call our superapp–and food was among the options.”

“Now, travel is back, AirAsia’s strength and Foodpanda’s strength is food. So we decided to give our huge database with our reward members an opportunity to get a much better food offering than we could ever do,” he explained.

In short, Fernandes declared that AirAsia is going back to focus on what they claim to be a strength: travel (including ride-hailing). “We believe that we could be a major player in ride-hailing, but in food, we can give a much better product by partnering with Foodpanda.”

The company said that the changes would also mean AirAsia superapp food will now focus solely on dine-in. The collaboration would also grant Foodpanda access to AirAsia’s assets, including reward programs, subscriptions, and wallets, and promote ride-hailing to their customers.

“So really it is a marriage made in heaven, which I can’t believe has happened today,” Fernandes told Tech Wire Asia at last week’s announcement. With the collaboration being effective in Malaysia since last Friday, Fernandes also iterated that both companies will replicate similar strategic partnerships across all other Asean countries in which both companies have a presence.

“We are starting in Malaysia; we roll out in Thailand next, then Singapore, the Philippines, Cambodia, all over,” he added. As with AirAsia’s current riders under its food delivery arm, Fernandes said they would be shifted to the company’s other services, such as its ride-hailing arm or Teleport, Capital A’s logistics arm.

An era of AirAsia + Foodpanda vs Grab?

The food delivery industry is often described as winner-takes-most. With that in mind, the current environment sees a handful of players in each country reducing the already razor-thin margins of the restaurant industry by engaging in cutthroat competition.

In late 2022, Grab, which also offers food delivery services on top of ride-hailing, is estimated to account for 54% or US$8.8 billion of the region’s food delivery GMV, a 16% increase from the year before. Foodpanda, which was always focused on food delivery services, is estimated to contribute 19% or US$3.1 billion of the region’s GMV, a 9% decline from 2021.

Gojek and Shopee, two companies that also only entered the food delivery service during the pandemic, are estimated to maintain their food delivery GMV at 2021 levels of US$2.0 billion and US$0.9 billion, respectively.

Some experts have also reckoned that the path to profitability lies in consolidation, as synergies with increased market shares and pricing power would allow for a more sustainable model. The partnership between Foodpanda and AirAsia may be their way of going up against Grab, their biggest rival in the region. We will have to wait and watch how the partnership further tightens competition in the market for other players.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network