How Temu became an e-commerce behemoth. (Source – Shutterstock)

What is Temu and how is it taking over the shopping landscape?

- Temu shines among e-commerce platforms due to its blend of social commerce, gamification, and affordability.

- However, concerns about authenticity, data security, and negative feedback are rising.

Wondering what’s behind the buzz surrounding Temu? You might be intrigued to learn why it’s been such a focal point of global interest. At its core, Temu offers a platform where various products can be procured at surprisingly affordable rates. Top it off, they periodically run “lightning” sales, where items can be snagged at almost 99% off their original prices.

Their diverse range spans from apparel and accessories to beauty essentials and home goods. But before diving in, let’s first understand what exactly Temu is.

What is Temu?

Temu, pronounced ‘tee-moo’, hails from Boston and is an online marketplace, the brainchild of PDD Holding, Pinduoduo’s parent company. While its operating model mirrors that of Chinese e-commerce giants like SHEIN, Wish, and Alibaba, Temu has carved a unique niche for itself.

Essentially, Temu bridges the gap between sellers, predominantly from China, and global buyers without maintaining a stockpile. It harnesses the power of social commerce, motivating shoppers to rope in more buyers to snag better deals. The platform incorporates gaming elements to boost user engagement and has managed to offer free shipping by adeptly navigating customs duties.

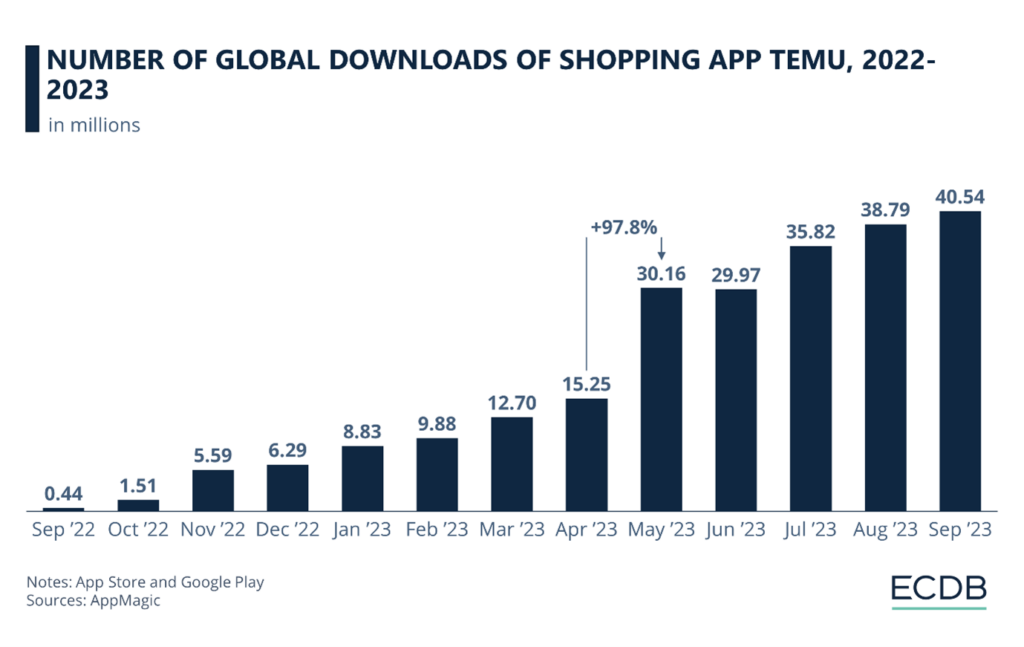

eCommerceDB notes an uptrend in Temu’s app popularity on platforms like Google Play and the App Store. Its debut in September 2022 saw around 440,000 downloads. By April 2023, this number had escalated to 15.3 million. A sharp surge of approximately 98% was observed by May 2023, pushing downloads past the 30 million mark – likely spurred by the media spotlight on Temu. Despite a minor slump in June 2023, downloads resumed their upward trajectory, recently clocking in at over 40.5 million in September 2023.

Downloads of Temu from 2022 to 2023. (Source – eCommerceDB)

However, app downloads are just one piece of the puzzle. Data from Similarweb provides insights into the traffic on Temu’s website, temu.com. The site’s visitation numbers overshadow the app downloads, which is understandable given the ease of website access over app installations. A similar surge was witnessed between April and May 2023, shooting up by 96.5% from 110.6 million visits in April to 217.3 million in May, likely due to amplified media coverage.

What sets Temu apart from other e-commerce platforms?

So, what makes Temu resonate with the masses?

A vast product assortment paired with an engaging, game-centric shopping interface makes Temu a favorite. Its rapid ascent and unique approach have made it a business model worth dissecting.

Breaking down Temu’s five strategic pillars

At a glance, Temu attracts customers with its competitive pricing, free shipping, and enticing discounts. Drawing parallels with SHEIN, Wish, and Alibaba, Temu’s affordability is its strength. Yet, they go further with their free shipping and returns – a feat made possible due to PDD Holding’s expansive supply and distribution networks.

The significance of an efficient logistics framework can’t be stressed enough, especially given the challenges faced by Alibaba and Wish in penetrating the Western market. Furthermore, Temu manages to outdo even SHEIN with its discount offerings.

Blending retail and recreation

A fifth of U.S. online shoppers look for a tactile shopping experience. Temu’s remedy? Incorporating gaming into the shopping journey. Games such as Fishland, Coin Spin, and Card Flip can be played for rewards, enhancing user engagement.

Referrals play a pivotal role in sustaining this gaming feature.

Group purchases: A collective bargain

A concept embraced in Asia, group buying is being introduced to the West by Temu. By consolidating purchases, consumers can tap into bulk discounts. This aligns seamlessly with Temu’s referral scheme, fostering a communal shopping environment.

Influencer partnerships and aggressive marketing

Mirroring SHEIN’s strategies, Temu gifts products to various influencers, especially targeting platforms like YouTube and TikTok. They prioritize the younger demographic, understanding their hesitance to splurge on luxury items. Witnessing a favorite influencer or peer endorsing Temu’s offerings can sway young shoppers towards a purchase.

Balancing innovation with ethics

Temu’s most groundbreaking yet contentious strategy is its reverse-manufacturing approach, mirroring SHEIN. This process channels real-time customer feedback to producers. Initially, limited product quantities are listed, with popular items reordered and less-demanded ones phased out. Temu claims this promotes environmental sustainability by syncing product supply with real-time demand, allowing for a more diverse product array. This approach enabled SHEIN to unveil 150,000 new products in 2020, overshadowing its rivals.

Understanding Temu’s affordable pricing

One of the standout features of Temu is its affordability. This is largely attributed to consumers interacting directly with the primary sellers, bypassing any middlemen. Moreover, Temu follows the “loss leader” approach, prompting sellers to trim their profit margins to bolster the platform’s overall market presence. This strategy allows Temu to offer significant discounts. However, some speculate there are more reasons behind the app’s ultra-low prices.

While Temu’s low prices are enticing, there’s also a downside. Within a year of its inception, Temu garnered negative attention. Time Magazine highlighted issues such as undelivered items, mysterious charges, erroneous orders, and a lackluster customer service response.

Numerous complaints have been filed against the company with the Better Business Bureau, resulting in a mediocre C+ rating.

Furthermore, while the U.S.-China Economic Security Review Commission didn’t explicitly label the platform untrustworthy, it cited concerns about product quality and potential copyright infringements.

Is it legit among other e-commerce platforms?

On Temu, the adage “you get what you pay for” rings true. If a deal appears too good to be true, you might end up with a subpar or imitation version of the intended product. These alternatives often fall short in terms of durability and quality.

Hicober, a hair towel retailer on Amazon, is among several entities that have pursued legal action against Temu, accusing it of selling counterfeit products. China’s Shein, which operates similarly to Temu, has also initiated lawsuits against Temu for allegedly replicating product listings and engaging influencers to tarnish the Shein image. However, it’s worth noting that Temu also lists recognized, blue-checkmarked brands, which are generally considered reliable.

Data security concerns with Temu

There’s growing apprehension surrounding the security facets of the Temu app. A shopper reported to Daily Dot that her American Express card details were compromised after her Temu shopping spree.

While data collection is a common practice for market analysis in the West, Chinese firms sometimes have to share this data with their government. Temu amasses a range of user data, encompassing personal details, access to social media images, and even sensitive information like social security numbers.

Is Temu actually good? (Source – X)

Steve Bernas, Chicago BBB’s President and CEO, suggests that using the app essentially creates a profile of you. With accumulating data, identity theft risks heighten. The connection to China raises red flags since data can be misused in ways detrimental to the U.S.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network