Vietnam is actually one of the top countries in the world in the gaming industry. (Image – Shutterstock)

Can Vietnam be a powerhouse in the gaming industry?

Gaming is one of the fastest-growing industries in the world today. As well as the number of gaming companies globally, the gaming community is also growing, giving their support to independent game developers too.

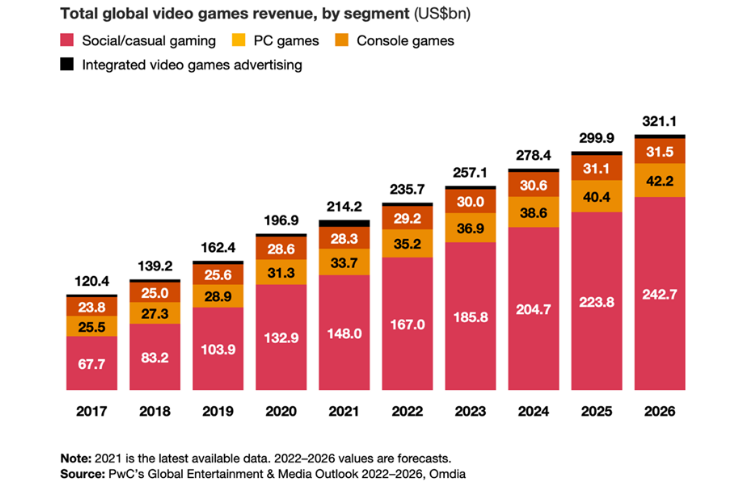

The gaming industry is tipped to maintain its rapid growth, and could be worth US$321 billion by 2026, a PwC report says. Continuous technological advancements in the gaming industry are significantly propelling the industry’s growth. They are enhancing the way games are created and improving the overall gaming experience of the users.

While console games like PlayStation and Xbox have been dominating the industry for many years, mobile phone gaming is now the biggest contributor to the gaming industry. Revenue in the mobile games market is projected to reach US$377 billion and have 2.3 billion users by 2027.

Popular mobile phone games like PUBG, Pokemon Go, and bMobile World Legends continue to push growth for the gaming industry. China remains the country that will generate the most revenue in gaming, despite regulations being made on the number of hours school students can play games.

At the same time, there is also an increase in cloud gaming services. These games focus on leveraging hyper-scale cloud capabilities, streaming media services, and global content delivery networks to build the next generation of social entertainment platforms. These factors have an anticipated positive impact on market growth. Cloud technology in the gaming market is likely to drive the demand and engagement of multi-players for different games.

Global gaming industry revenues are expected to exceed $320 billion by 2026. (Image: PwC)

Southeast Asia’s gaming industry

The gaming industry in Southeast Asia is a rather unique one. While the level of digital transformation and technology adoption varies in each country, when it comes to gaming, almost all ASEAN nations are moving at the same pace.

With half of Southeast Asia’s leading mobile game publishers being Chinese companies, some western companies are also beginning to move their headquarters to this part of the world.

The gaming developer community is also growing in Southeast Asia. Companies such as Tencent Holdings, NetEase, Nexon, and Garena are among the major players, developing and publishing successful games catering to this market. Garena, a Singaporean company, was the biggest gaming company in Southeast Asia in 2021, in terms of profits.

In Malaysia, UK-based gaming company Double Eleven expanded in 2022 and opened a studio in Malaysia, where it plans to build its SEA base. In 2023, Xsolla, a video game commerce company headquartered in the US, officially opened its new Kuala Lumpur office. The Malaysian location will reportedly be Xsolla’s largest office outside of Los Angeles.

In Singapore, the country’s approach to developing the gaming sector has focused on posturing itself as a regional gaming hub for top global studios like Ubisoft, Riot Games, and Bandai Namco. The Singapore government has also provided funding and support for Ubisoft and other multinational companies in the country, in the hope that these studios will help cultivate more local game developers.

A Tweet on Vietnam’s growing gaming industry.

Vietnam’s gaming industry

While Malaysia and Singapore continue to develop game developers, Vietnam is actually making a big mark in the gaming industry. In the first half of 2023, Vietnam is one of the top five nations in terms of mobile game downloads, as indicated by data.ai.

Remember Flappy Bird? It remains the most popular game to come out of Vietnam. Since then, Vietnamese gaming developers have faced growing challenges in the industry, especially with stricter data collection regulations.

According to a report by Bloomberg, despite being one of the five countries under communist governance, the burgeoning gaming sector’s growth in Vietnam isn’t particularly surprising to those familiar with its economy. The nation boasts remarkably high smartphone penetration rates in Asia, coupled with a youthful demographic where nearly half of its population is below the age of 30.

Driving this phenomenon is a burgeoning group of game developers and fledgling publishing startups in the local gaming industry. Amanotes, renowned for its mobile music-themed games, and OneSoft, the publisher behind Falcon Squad, exemplify this ascent.

Furthermore, their success reflects Vietnam’s accomplishments in strengthening its educational framework. Vietnamese students consistently outshine their peers in the U.S. and other countries on PISA test evaluations, while a fervent interest in engineering and technology prevails. Coding camps tailored for children are progressively gaining traction, and academic institutions have incorporated game development into their curricula.

The government appears to be supporting the growth of Vietnam’s gaming industry as well. It recently decided to scrap plans for taxing online gaming services, providing some relief to domestic gaming companies.

Interestingly, Vietnam is already a popular alternative for US companies that are looking to move manufacturing out of China. Perhaps this could also lead to more American gaming companies setting up hubs in Vietnam as well. For now, Vietnam’s gaming industry seems to be headed in the right direction and could be a powerhouse in the future.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network