Amazon steps up to stay in the AI race. (Source – Shutterstock)

Can we expect a new AI from Amazon soon, given its up to US$4 billion investment in Anthropic?

- The Amazon up to US$4 billion investment in Anthropic, signals its commitment to fortifying its position in AI and cloud services.

- This investment promises Amazon customers early access to advanced AI technology.

In the rapidly evolving landscape of AI, the global rush towards pioneering generative AI is escalating at an unprecedented rate. Across the globe, countries and corporations are vigorously working on developing generative models capable of creating innovative and never-seen-before outcomes. This relentless pursuit, characterized by notable advancements and intense rivalry, underscores the collective aspiration for superior AI capabilities that promise a revolution in innovation, efficiency, and problem resolution.

In this competitive arena, Amazon emerges as a committed contender, ready to vie with other technological giants. The global e-commerce behemoth recently disclosed its plans to channel up to US$4 billion in cash into the prominent startup, Anthropic, aiming to parallel its competitors in the AI realm and fortify its position in cloud services.

As part of this strategic alliance, Amazon’s workforce and cloud patrons will be granted privileged access to Anthropic’s pioneering technology, designed to integrate advanced AI into their diverse operations seamlessly. This San Francisco-based startup vows to predominantly utilize Amazon’s extensive cloud services, including the procurement of a substantial volume of proprietary chips for training its forthcoming AI models.

A deeper look into the investment from Amazon to stay in the AI race

A disclosure by Reuters illuminates the financial intricacies of the deal, revealing an immediate investment of US$1.25 billion, alongside an optional additional funding of US$2.75 billion by Amazon. While the exact details remain undisclosed, Amazon’s minority stake in Anthropic does not entail a board position, underscoring its strategic financial investment in the AI domain.

This groundbreaking partnership signals Amazon’s robust response to the burgeoning advancements by its rivals, Microsoft and Alphabet’s Google, who have made significant strides in AI technology this year. The partnership further highlights the continuous strategic collaborations between cloud service giants and innovative AI startups that are collectively reshaping the technology industry landscape.

Highlighting other major collaborations, since 2019, Microsoft has significantly invested in its partnership with OpenAI, the creator of ChatGPT, providing its clientele exclusive access to cutting-edge prose-writing and image-generating technology. Similarly, Google, a pioneer in AI technology, recently invested in Anthropic’s US$ 450 million fundraising, reaffirming its commitment to bolstering advancements in AI technology.

In a significant development, Anthropic and other leading tech entities like Google parent Alphabet, Microsoft, and OpenAI were invited to a pivotal meeting at the White House, reinforcing the startup’s prominent position in the responsible AI development discourse. Moreover, Anthropic’s recent collaboration with Slack, through the introduction of a chatbot app, showcases its continual expansion and integration into diverse technology platforms.

For Amazon, this strategic partnership signifies potential growth in demand, including a surge for AI-powered chips. Anthropic’s commitment to collaborate on technological development for Amazon’s proprietary Trainium and Inferentia chips further cements the deal’s significance. Both CEOs, Adam Selipsky of Amazon Web Services and Dario Amodei of Anthropic, express the mutual benefits of the partnership, emphasizing advancements in model and technology enhancement, and a shared commitment to prioritizing safety and scalability in AI development.

Anthropic, established by previous OpenAI executives, including Amodei, stands among a burgeoning group of companies dedicated to constructing generative AI, technologies capable of generating human-like content. The company sets itself apart by emphasizing the incorporation of ethical values within its AI training. While Amodei did not comment on the competitive nature of the latest funding, he confirmed the continuation of an agreement announced with Google in February, wherein Anthropic utilizes Google’s custom chips, with plans to make its technology accessible via Google Cloud and beyond.

However, the recent collaboration with Amazon infuses fresh vitality into Amazon Bedrock, a service gaining traction among thousands for building AI applications. With early access to Anthropic’s advancements, Amazon’s clients will enjoy enhanced customization of their AI. As emphasized by Selipsky, the commitment to make future versions of Claude available on Amazon Bedrock is a pivotal aspect of the deal.

Anthropic’s growing collaborations and technology integration

Claude 2, Anthropic’s AI model, excels in responding to extensive prompts, positioning it as an adept tool for the analysis of lengthy business or legal documents. As noted by Amodei, the deal fortifies the push towards expanded enterprise usage for Claude, a development witnessing significant demand on Bedrock. Collaborations with data analytics firm LexisNexis, and other notable names like Bridgewater Associates and Lonely Planet, underscore the growing enterprise integration of Anthropic’s technology.

Despite not yet achieving the recognition or usage level of OpenAI, the entity behind the celebrated GPT-4 model and ChatGPT, Anthropic is making significant strides in the AI landscape. Amazon’s strategy, aimed at providing customers with diverse AI models, further minimizes the need to explore external cloud services. Regarding future investments in additional AI startups beyond Anthropic, Selipsky maintains an open stance, acknowledging the unpredictability of the future landscape.

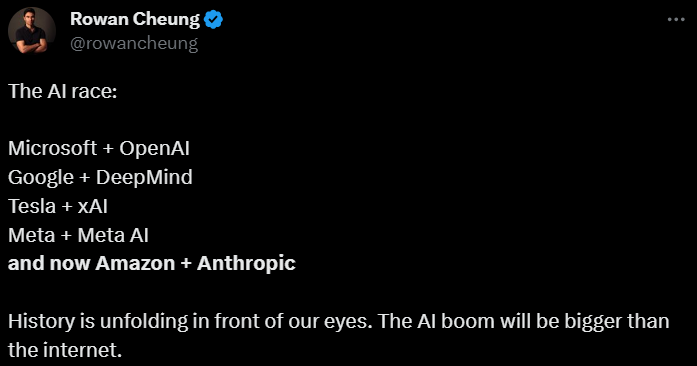

The AI boom will be bigger than the internet. (Source – X)

Why you need AI investments as race speeds up

Amazon’s substantial investment of US$4 billion into Anthropic, a competitor of ChatGPT, underscores the paramount importance of AI exposure in investment portfolios, asserts Nigel Green, CEO of deVere Group, a leading global financial advisory, asset management, and fintech organization. This assertion follows Amazon’s recent announcement of its significant investment and minority ownership in Anthropic, a company established by former executives of OpenAI, the creator behind ChatGPT, and the introducer of a new AI chatbot, Claude 2.

Green emphasizes the augmented competition this move signals among tech behemoths like Amazon, Microsoft, Google, and Nvidia in the burgeoning field of AI. This escalating AI race, marked by a genuine push to spearhead advancements, deployment, and utility of AI technologies, is poised to revolutionize diverse industries and spur unprecedented innovation. Such transformative potential, Green stresses, underscores the necessity for robust AI investment exposure in investors’ portfolios.

Despite the pervasive buzz surrounding AI, Green highlights that we are in the nascent stages of the AI epoch, urging investors to seize the early advantage. Initial investments in AI allow for establishing a competitive edge, access to favorable entry points, and the maximization of potential profits owing to the anticipated exponential growth accompanying the broad adoption of AI technologies. Such early investments stand to yield substantial returns as these technologies gain momentum and their valuations soar.

The AI race is heating up between the tech giants. (Source – Shutterstock)

However, amidst the AI investment fervor, Green accentuates the enduring relevance of diversification across various asset classes, sectors, and regions to optimize returns and mitigate associated risks and volatility. This strategy remains pivotal for long-term financial robustness, ensuring risk reduction, smoothing volatility, exploiting varied market conditions, and safeguarding against unexpected external occurrences.

In his concluding remarks regarding Amazon’s recent AI investment, Green categorically states the transformational nature of AI, emphasizing its nonpareil significance as a technological trend and the imperative for investors to integrate it comprehensively into their investment portfolios.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network