This photo taken on October 30, 2023 shows a poster for the new iPhone 15 at an Apple store in Shenyang, in China’s northeastern Liaoning province. (Photo by AFP) / China OUT

iPhone 15 Pro Max pushes Apple to its highest-ever Q3

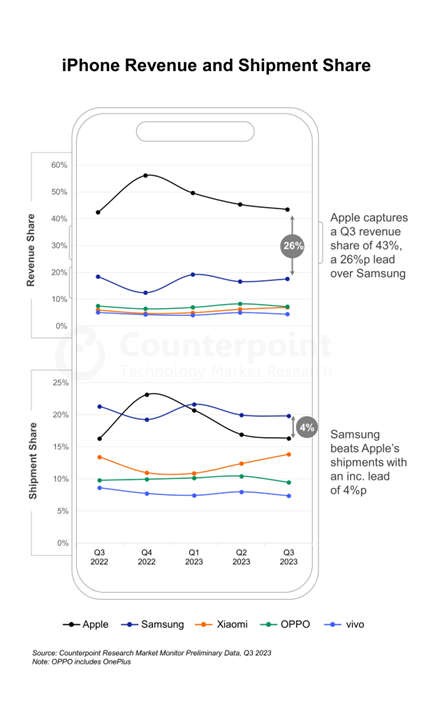

- Despite global smartphone revenues remaining flat YoY in Q3, Apple led the market with record quarterly revenue and revenue share.

- The revenue boost was mainly due to the sale of the Apple iPhone 15 Pro Max.

- Apple’s global smartphone operating profit share remained flat due to a resurgence of Huawei and Honor and an increased focus on profitability by Xiaomi and Oppo.

When the Apple iPhone 15 collection was released two months ago, it was, like its predecessors, received fairly well by consumers around the world – except in China. Time and sentiment were the main culprits, as the introduction of the latest series of iPhones in China came weeks after the launch of Huawei’s Mate 60 Pro, which was hailed as a victory over US sanctions due to its advanced domestically produced processor.

The timing of the launch by Apple also coincided with a government directive to expand a ban on the use of iPhones in government agencies and state companies across China, underscoring the US giant’s growing challenges there.

For now, analysts remain divided about the longer-term impact of the ban in China, the world’s largest smartphone market. But the good news for Apple shareholders is that the iPhone is still doing reasonably well in its largest market–the US.

People queue up for hours outside Huawei’s flagship store in Shanghai on September 25, 2023, hoping to be able to buy the tech giant’s latest Mate 60 Pro mobile phone. (Photo by REBECCA BAILEY / AFP)

That has led to the Pro Max being the best-selling variant of the iPhone 15 series, contributing to Apple also achieving its highest-ever Q3 operating profit, according to the latest report by Counterpoint Research. The report also highlighted the fact that global smartphone market revenues remained flat year-over-year (YoY) despite growing by 15% QoQ to just over US$100 billion in Q3 2023.

“Apple led the market, with 43% share of global smartphone revenues, its highest-ever for a calendar Q3,” Counterpoint’s senior analyst Harmeet Singh Walia noted. This was despite Apple’s latest iPhone 15 series being available for one less week in the third quarter of 2023 compared with its predecessor in the same period last year.

“This translated into Apple also clocking its highest-ever share of global smartphone revenue for a September-ending quarter,” he added. That meant the global smartphone operating profit also reached an all-time high, signaling how the smartphone market has adjusted to the post-pandemic trend of lower shipments, Walia argued.

China’s OEM eroding Apple’s dominance?

Despite Apple leading the global smartphone market with record Q3 revenue and revenue share, its global smartphone operating profit share remained flat. Counterpoint attributed that to the resurgence of Huawei and Honor and an increased focus on profitability by other Chinese OEMs such as Xiaomi and Oppo.

“Counterpoint Research estimates that the Chinese smartphone market declined around 3% during the quarter. Apple’s China revenues fell 2.5% during the quarter. Considering the increased competition from Huawei 5G devices, this is a good signal for Apple and the iPhone 15 series – especially since the Pro Max and Pro were supply-constrained,” research director Jeff Fieldhack commented.

Apple led the global smartphone market with record Q3 revenue and revenue share. Source: Counterpoint Research

As for Oppo, its focus on phones with higher ASPs, such as foldables — of which the Oppo Find N2 Flip is the top-selling example in China — is helping it achieve profitability.

Yet, a slowdown in its expansion outside of China and India has brought about a YoY shipment decline, with Oppo’s smartphone revenue in the first three quarters of 2023 being the lowest since the pandemic, Counterpoint’s data shows.

Vivo, while remaining profitable, has faced more significant challenges in its home country, China, where its promotions have been less aggressive than those of Honor and Xiaomi. Consequently, Vivo’s smartphone revenue fell 12% YoY and is almost half of Q3 2021, Counterpoint’s data shows.

Xiaomi is the only top five smartphone brand to see shipment increases both QoQ and YoY in Q3 2023 as it strengthened its positions in key markets such as China and India.

Xiaomi also offered more affordable mid-range products at promotional prices to both retailers and consumers on the back of solid sales of the Redmi K and Note series, Counterpoint explained.

That led the Chinese OEM to achieve both revenue and operating profit growth, both sequentially and annually. Samsung’s ASP, on the other hand, grew 4% YoY due to the successful launch of the Fold 5, maintained momentum in S23 series’ sales, and a higher flagship share in major product lineups.

“Nevertheless, an 8% shipment decline in the same period offset the ASP increase, causing Samsung’s revenue to decline by 4% annually,” the Counterpoint report reads. Overall, the full impact of the iPhone 15 series is yet to be seen.

“While the latest iPhone series had underperformed in China in the launch quarter due to a shorter pre-holiday shopping period coupled with supply mismatches on the Pro Max, it could see improvement in the year-ending quarter with a strong 11.11 sales event performance, which should also benefit other Chinese smartphone vendors,” Fieldhack added.

The elongated festive season in India could boost shipments and revenues in the world’s second-largest smartphone market, where pent-up demand and 5G upgrades will also contribute to growth. Overall, Counterpoint believes the global smartphone market could end the year with cyclical change.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network