Based on their central bank estimate back in 2015, three out of four Malaysian struggle to raise MYR1,000 (US$250) in the event of emergencies. Source: Shutterstock

Can financial literacy help the Malaysian economy flourish?

THREE OUT OF FOUR Malaysian struggle to raise MYR1,000 (US$250) in the event of emergencies and about 32 percent of the population can only afford to manage a week’s worth of expenses if they were to lose their source of income.

According to Bank Negara Malaysia, this is because of the lack of financial literacy and awareness of the importance of savings.

These problems tend to be more pronounced with the segment of the country’s population whose income is among the bottom 40 percent (known as the B40 category in Malaysia).

One startup, however, is aiming to empower this particular group by helping them save using technology.

“Pod is a micro-savings app that helps young Malaysians save money, for now. Our bigger mission is to become a digital bank eventually,” Co-Founder and CEO Nadia Ismail told Tech Wire Asia in an exclusive interview.

What makes their platform different from the other fintech players as well as traditional financial institutions, is Pod’s ability to get people to start saving with as little as ten cents.

“It is pricier for traditional financial institutions to do this, and it is also costlier for them to reach out for the type of audience we’re currently looking at, which are youths aged 21 to 35,” explained Ismail.

According to her, this particular segment of the population in Malaysia and Southeast Asia does not have the proper tools and resources to start saving and to eventually invest their monies.

“We realize that it is very important to personalize the savings experience, as people may save for different reasons. That is why we make sure that personalization is a key element in delivering our service,” Ismail said, before adding that the bigger banks are not doing this at the moment.

Pod ensure seamless savings

By using emerging technology such as AI, Pod provides users with personalized, intuitive experiences to get them to save towards a predefined goal and provides them with insights on their spending patterns.

For example, if someone is consistently spending a specific amount every day on average, and spends slightly less on a particular day, Pod will prompt the user to move the “unspent funds” to the savings account.

“As we capture more information and data, and learning more out our users, Pod will eventually be a highly personalized platform that offers useful and beneficial financial insights,” said Pod’s Fellow Co-Founder and COO, Yingteng Ng.

Ng pointed out that financial platforms currently available in the market only show the transactions as is, which is not as valuable.

Beyond AI, Pod also will be using API integrations to enable users to save money while spending at their favorite merchants and retailers.

By rounding up users’ leftover change, Pod transfers the balance into users’ savings account, so that users can make progress toward their goals, passively, explained Ng.

Pod’s innovative solution to empower the B40 community in Malaysia got them noticed in the fintech community across the world.

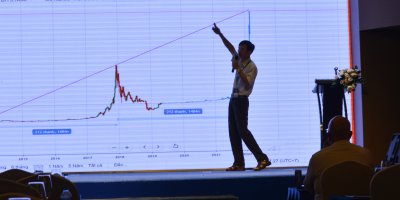

They were among the three finalists highlighted at MyFintech Week 2019 earlier this month, as part of the Malaysia B40 Challenge, an initiative by Financial Innovation Lab Malaysia.

The Financial Innovation Lab is a collaborative project by UNCDF, Bank Negara Malaysia, and MDEC that is funded by the MetLife Foundation.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network