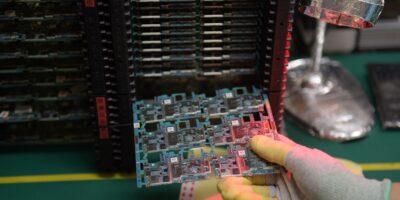

(Source – Shutterstock)

Micron believes 2022 is a big year for the semiconductor industry

- Micron reckons it to be a great time to be in the memory and storage business and this year would be significant for the semiconductor industry.

- The company anticipates a vaccine-driven economic recovery combined with secular trends such as acceleration in both mobile and automotive.

- 2022 will see the beginning of immense transitions for data center architectures, with memory and storage driving much of it.

For Micron Technologies, there is no better time to be in the memory and storage business than now. In fact, the US-based hardware memory manufacturer reckons 2022 “will be a big year for the semiconductor industry”.

In particular, Micron Malaysia’s Vice President Amarjit Sandhu, in an interview with Tech Wire Asia said, 2022 will see the beginning of immense transitions for data center architectures, with memory and storage driving much of it. “This is the era of composable architecture, with service providers and enterprises increasingly focused on sustainability and with data security an ever-present concern,” he said.

Emphasizing how this year will be a “big year for the semiconductor industry”, Sandhu noted that there will also be greater demands for the technologies used daily and the cloud to edge infrastructure needed to deliver it.

Below is the rest of the interview where Sandhu discussed with TWA on his outlook for the industry from Micron’s vantage point.

Perhaps you can share your outlook for the semiconductor industry — with the chip shortages and the supply chain issues that have wreaked havoc around the world.

We are very excited about the growth and health of our diverse array of end markets – a great time to be in the memory and storage business. Overall, we are well positioned for recovery and growth in 2022.

With a brand-new year ahead, and new insights from the year behind us, we anticipate a vaccine-driven economic recovery combined with secular trends such as acceleration in both mobile and automotive, which are strong tailwinds for Micron. NAND bit demand is expected to be in the high 30% and DRAM bit demand to be in the low 20%.

Would you reckon that the world is still too dependent on Asia for most of the semiconductor needs?

The pandemic [had] exposed vulnerabilities throughout the industry’s semiconductor supply chain and has highlighted the importance of investing in resilient supply chains across the semiconductor industry.

As a global manufacturing network with diversified sources of supply we have not only successfully navigated Covid-19 across our global manufacturing network but we have maintained a continuous supply to our customers.

Can you share about the supply chain from Micron’s vantage point — the different challenges the company is facing across different markets.

Micron has a globally distributed network of supply chain, manufacturing and customer lab operations. We have a supplier network with a presence in more than 30 countries and 11 customer labs providing individualized, localized support.

We have all seen first-hand the necessity of a globally diverse supply chain. Now is the time for industry and governments to invest in manufacturing across the globe to ensure that capacity is not concentrated in any one region. Micron’s diverse manufacturing footprint has been a great asset to ensuring our ability to reliably supply our customers.

We have placed a tremendous focus on building supply chain resiliency through data analytics and proactive actions to understand and mitigate risks and shortages. We have made strategic investments in creating redundant supply capability in different geographies to enable supply chain flexibility.

Do you foresee a better year for the semiconductor industry this year?

This year will be a big year for the semiconductor industry, as access to data becomes even more pervasive – enabling emerging usage models and incredibly rich, interactive experiences – we’ll see greater demands for the technologies we use daily and the cloud to edge infrastructure needed to deliver it.

These demands, in turn, will require unprecedented levels of technology innovation for a growing array of devices that we use to interact with our data at home and on the move. In 2021, we announced significant investments in manufacturing, R&D, sustainability and many more initiatives to help meet the continued growth in demand for innovative memory and storage technology.

In 2022, we must continue to drive innovation in the face of that exponential demand across industries for high-bandwidth, energy-efficient solutions — from devices to the intelligent edge to the cloud.

The future of data center

2022 will see the beginning of immense transitions for data center architectures, with memory and storage driving much of it. This is the era of composable architecture, with service providers and enterprises increasingly focused on sustainability and with data security an ever-present concern.

A new memory and storage hierarchy is bringing a revolution to data centers in 2022. Innovations across various types of memory will be key to unleashing data-intensive workloads. The most exciting transition will be the ramp of DDR5 and the emergence of the first Compute Express Link (CXL) based memory solutions, an initial step on the path to data center composability and memory pooling.

Data centers operators will also be more composable, leading to a drastic impact on energy and water consumption, carbon emissions and waste. Data centers will no longer be perceived as just components, rather they will be key enablers of their business and sustainability goals.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network