Source – Shutterstock

AR/VR technology spending in APAC to reach US$ 14.8 billion

- APAC spending on AR/VR solutions is anticipated to reach US$ 14.8 billion by 2026

- Discrete manufacturing, education, professional services, healthcare providers, and personal and consumer services accounted for more than 66% of overall spending in 2022

Remember Nick Fury’s AR windshield heads-up display, which he used to answer calls, maneuver through traffic, and inspect the vehicle’s systems? The Avengers and other films like them have shown how AR/VR completely transform how audiences and filmmakers watch movies. However, they are not only being used for a film. From gaming and entertainment to education and training, AR/VR technology is being used in various industries to create immersive and engaging experiences that were previously unimaginable – and the APAC region is accelerating this adoption.

The APAC region has seen significant growth in the adoption of AR/VR technologies in recent years. Many countries in the region, such as China and South Korea, have invested in AR/VR research and development and are home to many companies specializing in these technologies.

According to the latest release of IDC’s Worldwide Augmented and Virtual Reality Spending Guide, APAC spending on AR/VR solutions is anticipated to reach US$ 14.8 billion by 2026, rising at a CAGR of 40.1%.

A significant portion of VR spending comes from the consumer sector, which is anticipated to exhibit a similar trend throughout the projected period. However, expanding commercial use cases, such as those involving training, teamwork, and metaverse-related activities, are anticipated to present significant growth prospects.

Historically, AR solutions have satisfied businesses’ designing and troubleshooting requirements, and this trend will continue over the predicted period. However, new products introduced by several vendors in the forecast’s later years are anticipated to provide the consumer market with new options for its needs in terms of entertainment and personal productivity.

“AR/VR technology is set to transform how we live, work and play,” said Dr. Lily Phan, Future of Work, Research Director, IDC Asia/Pacific. The technology has opened new opportunities for gaming, entertainment, consumer, healthcare, manufacturing, education and many more. As the technology gets more perfected and the metaverse is more embedded in the future of work, spending on AR/VR will see strong growth rates of up to 40% in the next few years.”

Industries that are investing in AR/VR technology

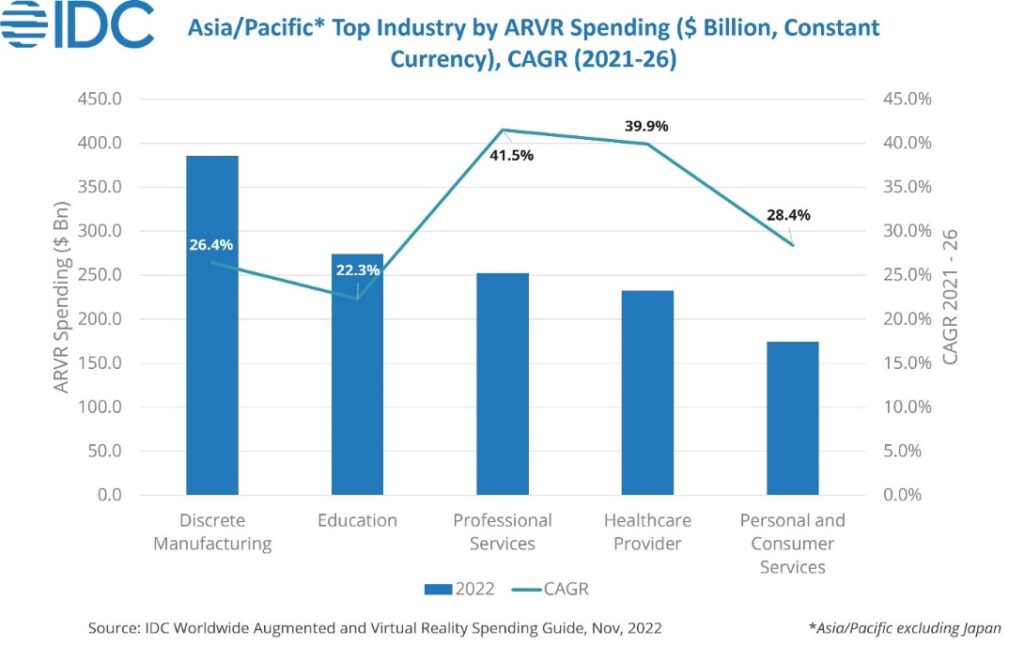

Among the 19 commercial businesses IDC tracks, discrete manufacturing, education, professional services, healthcare providers, and personal and consumer services accounted for more than 66% of overall spending in 2022.

In 2022, training became the primary use case for personal and consumer services, healthcare, and discrete manufacturing. Professional services displayed the highest CAGR of 41.5% due to the growing need for more effective collaboration that facilitates sharing and engagement across the entire organization. Similar trends for collaboration use cases were also seen in healthcare, which is anticipated to cost US$ 44.7 million by 2026. 360-degree educational video viewing (post-secondary) emerged as the most promising use case during the predicted period, with a CAGR of 48.1%. AR/VR technology will provide a more immersive learning environment by enabling information virtualization, fostering students’ ability to innovate, solve problems, and think analytically.

AR/VR spending in APAC to reach US$ 14.8 billion, driven by remote meetings, training, and collaboration. (Source – IDC)

The introduction of the metaverse gives the AR/VR business a boost. Six key markets—entertainment, social, education, financial, and work—will be impacted by AR/VR, AI, cloud, and blockchain technologies. As the metaverse will significantly rely on AR/VR solutions to create an engaging and immersive user experience, metaverse gateway, applications, and accessories should be built around AR/VR platforms.

The lack of competitive rivalry and recent technological investments made by Meta in AR/VR technology are anticipated to encourage other businesses, including Sony, Apple, and Pico, to enter the market in the later years of the forecast period, providing promising growth opportunities for new players and a wide range of choices for consumers.

According to Abhik Sarkar, a market analyst with IDC Asia/Pacific IT Spending Guides, Customer Insights & Analysis, Web3 and metaverse are essential factors influencing new business goals.

“The entertainment industry will likely be disrupted the most as virtual entertainment becomes more polarized. The metaverse development will also help improve marketing and digital economy as eCommerce will continue to showcase accelerated growth due to immersive and comprehensive customer experience.” Sarkar added.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network