Saudi Arabia’s ambitious journey to AI supremacy (Source – Shutterstock)

Saudi Arabia could become the largest player in the AI industry

- Saudi Arabia is ambitiously positioning itself as a global leader in technology, unveiling plans for a US$40 billion investment in AI.

- Saudi Arabia also focuses on talent attraction and innovation to become a global AI powerhouse by 2030.

For years, the United Arab Emirates (UAE) has stood out as the premier technology hub in the Middle East, a status bolstered by its appealing lack of personal income tax, accommodating visa policies, and enticing incentives for global businesses and professionals. However, Saudi Arabia is now positioning itself as a formidable challenger in this domain.

At this juncture, the emergence of Saudi Arabia as a contender in the tech arena should hardly come as a surprise. Last year, the country unveiled plans for the Mukaab, an ambitious cube-shaped skyscraper project. This supertall structure, envisioned to cover an area approximately one-third the size of Manhattan, aims to set a new benchmark as the world’s largest built structure.

Saudi Arabia and its bold leap into AI investments

The latest developments from Saudi Arabia further underscore its tech ambitions, with The New York Times reporting the government’s intention to establish a US$40 billion fund dedicated to artificial intelligence investments. Informed by insiders, this significant initiative marks in the global race to harness and shape the future of AI technology.

The Mukaab is expected to be more than just an architectural marvel; it plans to house a museum, a technology and design university, and a versatile theatre. This could potentially mirror or even surpass the innovative features seen in Dubai’s Museum of the Future, which boasts a variety of AI-powered attractions, suggesting that the Mukaab’s offerings could integrate AI technology in groundbreaking ways.

Recent discussions between Saudi Arabia’s Public Investment Fund and prominent figures in the venture capital world, including Andreessen Horowitz, indicate a serious interest in forging partnerships. Despite these plans being subject to change, the ambition behind them is clear, positioning Saudi Arabia as a potential heavyweight in the global tech landscape.

By aiming to establish the world’s largest AI investment fund, Saudi Arabia not only showcases its business acumen but also signals its intent to diversify its oil-dependent economy and assert a more dominant role in international geopolitics. This move leverages the sovereign wealth fund’s substantial assets, furthering the nation’s strategic objectives.

Discussions with Andreessen Horowitz, a firm already deeply invested in AI, hint at the scale of Saudi Arabia’s ambitions. This proposed US$40 billion investment positions Saudi Arabia alongside SoftBank as one of the most significant global tech investors, eclipsing the financial efforts of most U.S. venture capital firms.

Saudi Arabia plans US$40 billion push into AI (Source – X)

The tech fund is being organized with assistance from major Wall Street banks, entering a market already flush with investment capital. This surge of investment into AI reflects a broader trend of soaring company valuations and fierce competition among investors to back the next big breakthrough in technology.

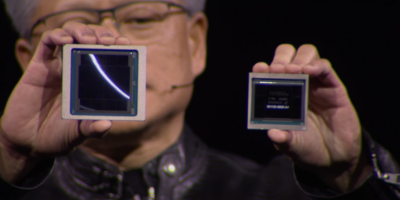

Financing AI ventures is expensive, as highlighted by OpenAI‘s CEO, Sam Altman, who sought substantial funding from the UAE to support AI chip manufacturing. Saudi Arabia’s interest in funding AI extends to supporting startups in chip manufacturing and data center operations, indicating a broad and ambitious strategy to influence the future of tech.

The future of Saudi Arabia’s tech landscape

Plans set to possibly accelerate by late 2024 could see Saudi Arabia’s investment initiative, in partnership with entities like Andreessen Horowitz, significantly impacting the tech sector. Discussions have even included the possibility of Silicon Valley firms establishing a presence in Riyadh, further solidifying the kingdom’s tech ambitions.

This venture could attract other venture capitalists, drawn by Saudi Arabia’s vast financial resources and ambitious tech strategy. The Public Investment Fund, established in 1971, continues to be a focal point for those tracking international business developments, especially given its evolving role in global investment trends.

Despite past controversies, including the murder of journalist Jamal Khashoggi and contentious investments, Saudi Arabia remains a compelling destination for technology investments. Its past financial engagements, including significant investments in companies like Uber and its contributions to SoftBank’s Vision Fund, highlight both successes and challenges in tech investing.

As Saudi Arabia reintegrates into the global business community, events like hosting Public Investment Fund officials during the Super Bowl showcase its ongoing efforts to forge connections and establish partnerships across industries, underscoring its enduring influence and ambition in the global tech landscape.

Saudi Arabia’s first AI humanoid robot (Source – YouTube)

Saudi Arabia’s economic milestones and talent attraction

Furthermore, Saudi Arabia is making strides in attracting talent, a key accelerator of its ambition to become a significant player in the AI arena. CNBC highlighted that Saudi Arabia’s economy has surpassed the US$1 trillion mark for the first time, dwarfing the UAE’s economy, which stands at just over US$500 billion according to World Bank data. Despite this, the UAE maintains a significant advantage, having invested heavily in its Advanced Research Technology Centers, which focus on areas like generative AI, cyber technology, quantum computing, and biotechnology.

However, the kingdom is also investing significantly in its aspirations to become a tech hub.

Experts at Davos mentioned to CNBC that while MBS’s construction of extravagant megacities in the desert captures public attention, the primary mission is talent attraction to sustain a value creation loop in AI.

At the helm of the King Abdullah University of Science and Technology (KAUST) is a mathematician from UCLA, who is pivotal in drawing talent to Saudi Arabia to foster innovation.

KAUST conveyed to CNBC its alignment with Saudi Arabia’s vision of becoming a global AI powerhouse by 2030, a journey supported by strategic partnerships. This includes the development of a National AI Strategy to aid startups and implement AI in government services, alongside Riyadh’s International Center for AI Research and Ethics (ICAIRE) and Saudi Aramco’s AI research hub focusing on cutting-edge oil and gas projects.

The university also highlighted its contributions through the AI Initiative and the hosting of the SDAIA AI Center, under the guidance of the Saudi Data and Artificial Intelligence Authority.

With plans for a US$40 billion investment in AI and significant efforts to attract and cultivate talent, the kingdom aims to diversify its economy and enhance its global technological footprint by 2030. While challenges exist, including navigating past controversies and fostering international partnerships, Saudi Arabia’s proactive approach to embracing the future of technology suggests a commitment to becoming a significant player in the global AI landscape.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network