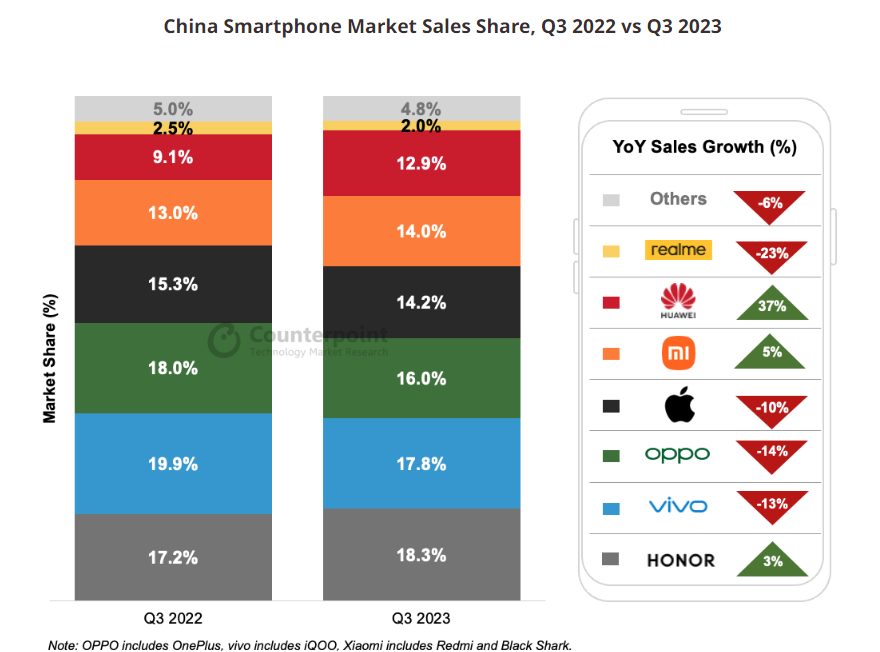

Sales of Huawei smartphones in China grew 37% YoY, commanding a 12.9% market share in the quarter while Apple declined.Photo: People queue up for hours outside Huaweis flagship store in Shanghai on September 25, 2023, hoping to be able to buy the tech giant’s latest Mate 60 Pro mobile phone. (Photo by REBECCA BAILEY / AFP)

Huawei grew quicker than Apple in China, thanks to its 5G smartphones

- Sales of Huawei smartphones in China grew 37% YoY, commanding a 12.9% market share in the quarter – while Apple declined.

- Apple saw double-digit declines because the iPhone 15’s launch sales volume was lower than that of the iPhone 14 series.

- Could the launch of the Mate 60 range see Huawei lead a Chinese fightback against US sanctions?

Not too long ago, the only real challenger for Apple in the high-end segment of the smartphone market in China was Huawei. But sanctions by the US knocked out the latter’s once mighty handset business. For a few years after that, Huawei, a company that once vied with Apple Inc. and Samsung Electronics Co. to lead the global smartphone market, suffered. But now, things are taking a positive turn for Huawei in the wake of its release of a collection of 5G-enabled smartphones, which poses new challenges to Apple in China.

While Huawei has prepared for years for a possible technology cutoff by the US government, no one was sure how self-reliant the Chinese telecommunication giant was. However, Huawei declared on December 30, 2022, that it has left behind the “crisis status” it entered in response to the US sanctions enacted against it in 2019.

But that was just the beginning.

No one, especially in the US, was prepared for what was coming in late August.

The company, in a rather subtle manner, unveiled the Mate 60 and Mate 60 Pro, followed by the Mate 60 Pro+. The groundbreaking thing about that series of smartphones was that they were all–without a single mention from Huawei–5G-enabled. What was more surprising was that Huawei used a domestically made chip, marking a breakthrough in the face of years of US technology sanctions against the company.

Huawei equipped the Mate 60, Mate 60 Pro, Mate 60 Pro+, and the Mate 60 RS with a 7nm homegrown Kirin 9000s application processor (AP) that supports 5G. The Mate 60 series featured the first 5G phones from Huawei since 2020’s Mate 40 series, which was powered by the Kirin 9000 chipset.

Huawei’s new generation of 5G smartphones drew crowds. (Photo by REBECCA BAILEY / AFP)

In the first six weeks of the release, Huawei sold 1.6 million units, according to Counterpoint Research.

That release alone was enough to propel Huawei to be the position of fastest-growing smartphone maker in China in the third quarter of this year. Sales of the Chinese technology giant’s smartphones in China grew 37% year-on-year(YoY), according to Counterpoint’s report released last week. It commanded a 12.9% market share in the quarter, up from 9.1% in the same period the previous year.

Huawei makes massive strides, while Apple stumbles over iPhone 15.

“It has made a huge splash in the market, contributing big to Huawei’s smartphone sales growth” in the third quarter, Ivan Lam, senior analyst at Counterpoint Research, explained. OPPO, Vivo, and Apple all experienced double-digit decreases in sales.

Lam said, “iPhone sales declined as some demand for older models was fulfilled in Q1 and Q2 2023 due to earlier-than-expected price cuts by channels, which were not offset by the official price adjustment. This was compounded by initial supply constraints faced by the iPhone 15 series, which resulted in lower sales compared to the iPhone 14 series for the launch period.”

Source: Counterpoint Market Pulse Service

But analysts also believe that if Huawei’s new chip is put into some mid-to-lower-end phones, the company could take market share away from other players and be propelled back into the top five.

“If Huawei expands the new Kirin chipset into its low-to-mid-range portfolio in the future, it has the potential to disrupt the competitive dynamic among leading vendors,” Lucas Zhong, a research analyst at Canalys, said in the firm’s report on China’s smartphone market, which was released Thursday.

According to Canalys’ report, Honor, driven by product and channel competitiveness, returned to the top position with an 18% market share and 11.8 million shipments. OPPO (including OnePlus) followed with 10.9 million shipments, securing thesecond spot. Apple came in third with 10.6 million shipments, benefiting from its new launch. Vivo, with a cautious shipment strategy, held fourth position with a 16% market share.

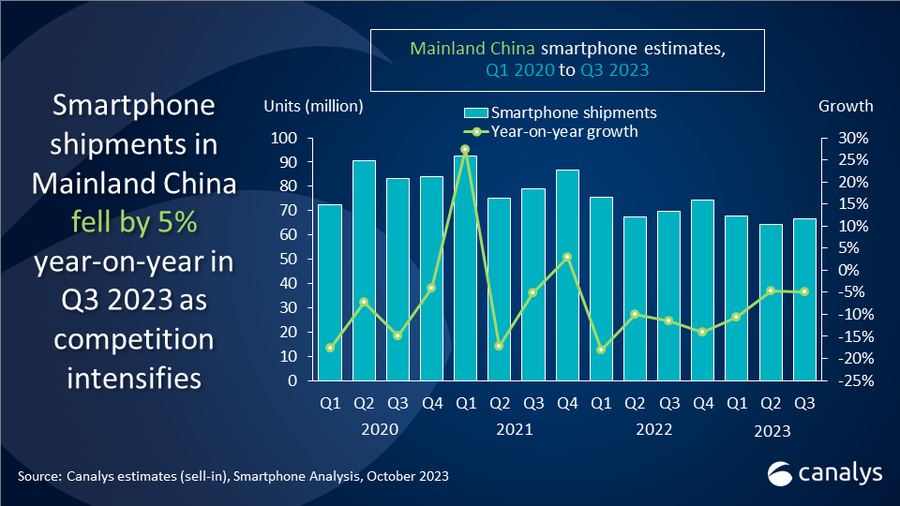

Canalys: Smartphone shipments in Mainland China saw a second consecutive quarter of modest decline, falling 5% to 66.7 million units.

“Xiaomi’s hot-selling series maintained its momentum, with a slight increase in market share to 14%, securing the fifth spot. Additionally, Huawei continued to gain market share and inch its way towards the top players through its high-profile Mate series launches,” the report noted. The research firm also believes that since shipments of smartphones for the third quarter of this year fell 5% YoY in China, the worst may be over.

Both Counterpoint and Canalys believe the smartphone market in China may have bottomed out and be on its way to recovery. Apple is expected to sell 10 million units of its new phone in China this year, for an expected total of 45.5 million iPhone sales in the country, according to Shanghai-based CINNO Research.

5G smartphones push Huawei to growth

When unveiling its financial results for the first three quarters of this year, Huawei said revenue rose by 2.4% YoY to 456.6 billion yuan (US$62.33 billion) — the highest since 2020. In contrast to the modest rise in revenue, profit rose 177.8% in the period to 73.05 billion yuan, according to Reuters calculations.

For the third quarter, revenue rose 1.5% to 145.7 billion yuan, “in line with forecast,” Huawei’s rotating chairman Ken Hu said.

Has the tide turned for Huawei in China with the launch of the Mate 60 series?

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network