A robust recovery in semiconductor sales is forecasted, with an expected growth of 13.1% in 2024, as per the WSTS report. Photo: Shutterstock.

Global semiconductor sales to pass US$588bn in 2024, fueled by memory surge

- A robust recovery in semiconductor sales is forecasted, with an expected growth of 13.1% in 2024.

- WSTS forecasts significant growth driven by the memory sector, set to reach approximately US$130 billion in 2024, marking a 40% increase from the previous year.

- In 2024, all regional markets are expected to grow, with the Americas and Asia Pacific showing significant double-digit YoY growth.

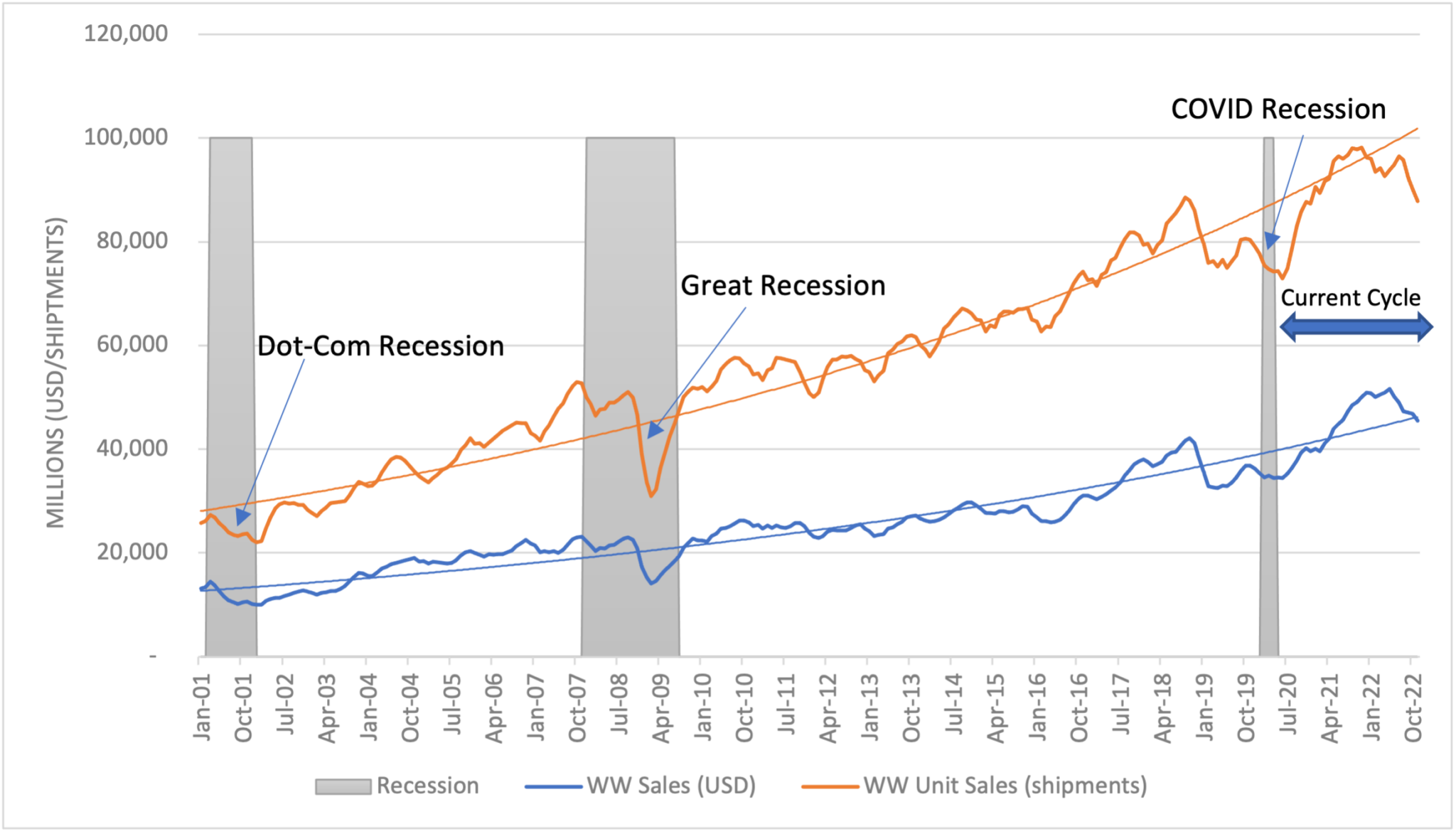

Over the last two decades, the semiconductor industry has exhibited remarkable and consistent growth when viewed beyond short-term demand fluctuations. With annual sales soaring from US$139 billion in 2001 to an impressive US$573.5 billion in 2022—an increase of 313%—the industry has witnessed significant expansion. Unit sales of semiconductors also surged by 290% during this period, indicating heightened demand across various sectors. The result? A US$1 trillion dollar industry by the end of the decade, as estimated by industry experts.

The upward trend is persisting, and according to World Semiconductor Trade Statistics (WSTS), the semiconductor market will experience a revival next year. “The outlook for 2024 points to a vigorous upswing in the worldwide semiconductor market, with projections indicating a 13.1% increase, reaching a valuation of US$588 billion.

The trend of semiconductor sales. Source: WSTS and SIA analysis.

The industry growth is expected to be primarily fuelled by the memory sector, which is on track to soar to around US$130 billion in 2024, representing an upward trend of over 40% from the previous year. “The majority of other principal segments, including discrete, sensors, analog, logic, and micro, are also expected to record single-digit growth rates,” WSTS said in its report.

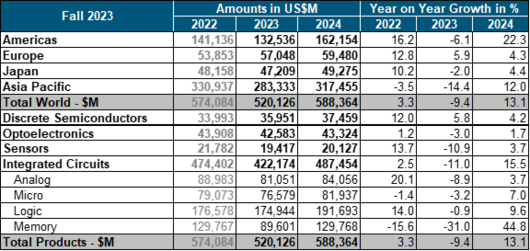

Surpassing the initial spring projections, WSTS has adjusted its forecast based on improved second-quarter (Q2) and Q3 results. The revised outlook foresees a single-digit contraction of 9.4% in the global semiconductor market for 2023, and now the updated market valuation for this year is estimated at US$520 billion. “Nevertheless, a strong rebound is expected in 2024,” the report reads.

From a regional standpoint, all markets are poised for ongoing expansion in 2024. “The Americas and Asia Pacific, in particular, are forecasted to demonstrate significant double-digit growth on a year-over-year (YoY) basis,” WSTS highlighted. Concurrently, even SEMI, in partnership with TechInsights, reported in the Semiconductor Manufacturing Monitor that the global semiconductor industry appears to be nearing the end of a downcycle and is expected to begin to recover in 2024.

Semiconductor sales into 2024. Source: WSTS

“Market indicators point to a semiconductor industry bottoming at the end of the first half of 2023, and the industry has since started a recovery, setting the stage for continued growth in 2024. All segments are projected to log year-over-year increases in 2024, with electronics sales surpassing its 2022 peak,” SEMI’s report indicated.

The most upbeat outlook is from International Data Corporation (IDC), forecasting a turnaround and accelerated growth in the coming year. But for 2023, IDC believes worldwide semiconductor revenue will grow to US$526.5 billion, down 12% from US$598 billion in 2022. For 2024, IDC sees YoY growth of 20.2% to US$633 billion, up from US$626 billion in the prior forecast.

IDC’s optimism stems from the belief that the US market will exhibit resilience in demand, and China is expected to commence recovery by the second half of 2024 (2H24).

Which semiconductor segments will see sales growth?

For this year, revising its growth projections upward due to more robust performance in recent quarters, WSTS notes improvements in specific end-markets. “In 2023, discrete semiconductors, primarily driven by power semiconductors, are expected to see a 5.8% YoY growth. However, all integrated circuit categories, including analog, micro, logic, and memory, are projected to experience an 8.9% decline compared to the previous year, a less severe downturn than initially forecasted in May 2023,” WSTS noted.

Regarding regional performance for 2023, the research firm believes only the European market is anticipated to grow, with a 5.9% increase. The remaining regions are expected to face a downturn, with the Americas declining by 6.1%, the Asia Pacific region by 14.4%, and Japan by 2%. For 2024, IDC anticipates improved visibility in semiconductor growth as the extended inventory correction concludes in major market segments like PCs and smartphones.

The market is predicted to rebound in 2024.

IDC also predicted elevated inventory levels in the automotive and industrial sectors are projected to normalize in 2H24, driven by the ongoing electrification trend that enhances semiconductor content over the next decade. “Technology and large flagship product introductions will drive more semiconductor content and value across market segments in 2024 through 2026, including the introduction of AI PCs and AI smartphones next year and a much-needed improvement in memory ASPs and DRAM bit volume,” the research firm noted.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network