Samsung reckons its April-June quarter would see an operating profit of 600 billion Korean won (US$458 million), down from 14.1 trillion won (US$10.8 billion) a year earlier.Source: Shutterstock

Chip oversupply may lead to the steepest profit decline in 14 years for Samsung

- Samsung is severely impacted by weakening demand in its key memory chips market.

- Samsung will report its full earnings for the quarter on July 27.

Since April this year, the world’s largest memory chip maker, Samsung Electronics Co., has anticipated its lowest profit for any quarter since 2009. So much so that the South Korean giant decided to cut back memory chip production as its operating profit in the second quarter of 2023 is expected to plummet about 96% from the previous year.

Before the second quarter of this year, Samsung wasn’t planning to slash its memory chip investment despite dwindling demand, hoping for a recovery of the memory chip market in the second quarter of this year. Unfortunately, prices for memory chips, its most significant business, continue to fall while demand weakens.

By the end of its January-March quarter, the company reported a whopping 4.58 trillion won (US$3.5 billion) loss in its chip business as memory chip prices fell further and its inventory values were slashed. Then came the most recent guide released last week, where the South Korean technology giant predicted that it would post more dwindling operating profit.

In a preliminary result announcement for the April-June period, Samsung said the company may have just recorded its worst overall operating profit in 14 years.

Precisely, Samsung reckons its April-June quarter would see an operating profit of 600 billion Korean won (US$458 million), down from 14.1 trillion won (US$10.8 billion) a year earlier. According to company data, that would mean Samsung’s lowest profit for any quarter since a 590 billion won (US$451 million) profit in the first quarter of 2009.

On the other hand, second-quarter sales will likely fall 22% to 60 trillion won from 77.2 trillion won, Samsung said in a short statement.

The end of memory chip downturn is in sight

The semiconductor industry has been grappling with its worst downturn in years after enjoying a pandemic-induced boom in tech purchases that boosted sales. Since last year, the global economic slowdown, inflation, and geopolitical tensions have prompted significant pullbacks in corporate and consumer spending on electronics that drive demand for memory chips.

“Prices for the two main types of memory chips, DRAM and NAND flash, peaked during the Covid-19 pandemic, driven by strong demand for tech products. Prices began falling sharply in the second half of last year, and the slump has continued into 2023 amid a supply glut. DRAM memory enables devices to multitask, while NAND flash memory provides storage functions on devices,” a Wall Street Journal report stated.

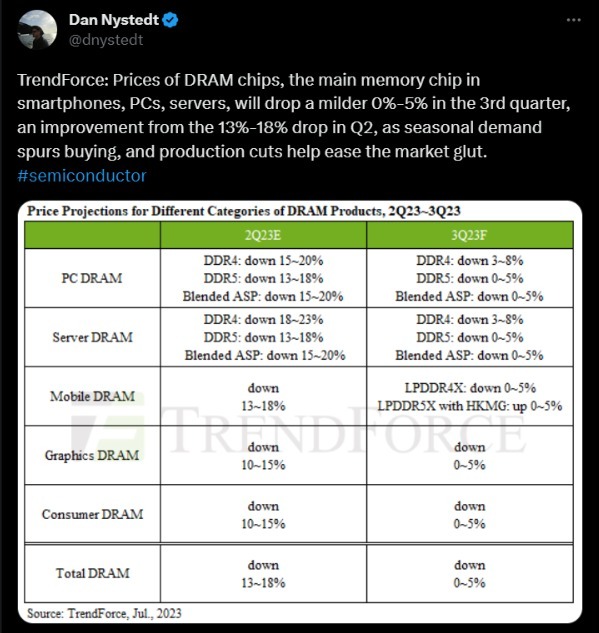

Prices of DRAM chips – widely used in smartphones, PCs, and servers – fell 13-18% in the second quarter from the previous quarter as buyers refrained from new chip purchases, according to market tracker TrendForce. In the third quarter, average contract prices of DRAM are projected to fall quarterly by 7% and NAND flash by 1%, and in the fourth quarter by 3% and 7%, respectively.

While production cutbacks may help to curtail quarterly price declines, a tangible recovery in prices may not be seen until 2024.

Source: Trendforce

That compares with double-digit quarter-to-quarter price falls for both types of memory projected for the first and second quarters, according to TrendForce. Even Gartner’s latest forecast suggests that “recovery is on its way – the slump will bottom out this year.”

Semiconductor Revenue Forecast, Worldwide, 2022-2024 (Billions of U.S. Dollars). Source: Gartner

Gartner’s report also noted that memory is likely to be the hardest hit part of the sector, with revenue projected to decline 35.5% this year to US$92.3 billion, mainly due to overcapacity and excess inventory pushing down the price of memory chips. The upside is that Gartner expects to see memory bounce back with a vengeance next year with a forecast 70% growth in revenue.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network