What does Samsung earnings guidance says about global chip demand.Source: Samsung

What does Samsung earnings guidance says about global chip demand

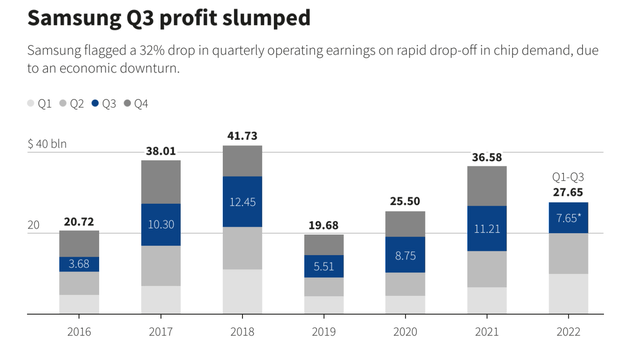

- In issuing earnings guidance, Samsung says it expects a worse-than-expected 32% drop in quarterly operating earnings.

- The South Korean giant attributed the economic downturn to slashed demand for electronic devices and the memory chips that go in them.

- Analysts expect Samsung to suffer from poor earnings for at least a couple more quarters.

Recent decades-high inflation, rising interest rates, and geopolitical tensions has been hitting the PC and smartphone market all around the world. That has also resulted in the semiconductor market grappling with a steep fall in demand, signaling that the tech downturn may be worse and longer-lasting than feared. One of the signs includes the preliminary third quarter results of Samsung Electronics, a smartphone and memory chip market leader. The South Korean giant foresees a bloodbath with operating profit possibly falling over 30%.

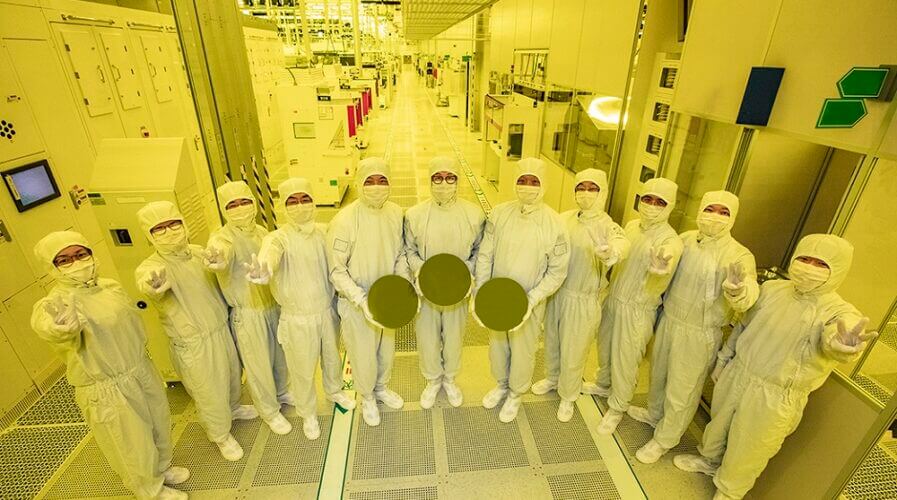

The world’s largest memory chipmaker, in an earnings guidance released last Friday, shows a possible 32% dive in operating income for the three months through September. Based on the guidance, the tech giant’s operating profit plunged 23.4% quarter-on-quarter, while revenue dropped 1.6%. Although the company did not elaborate, Samsung is expected to release its full earnings data, including its net profit, later this month.

For context, the earnings guidance flagged the first year-over-year quarterly profit decline in almost three years for Samsung. Frankly, as one of the world’s largest chip makers and electronics companies, Samsung Electronics is highly sensitive to the global economy and at this juncture, the global economy is slowly slipping into a recession.

Samsung Electronics, is expected to announce official Q3 2022 results on October 27

Even the global PC market faced a significant drop in demand in the third quarter of 2022, according to Canalys’ report. Total shipments of desktops and notebooks fell 18% to 69.4 million units, as existing weakness in the consumer and education segments was exacerbated by more cautious IT spending by businesses. “Adverse macroeconomic and industry factors including high inflation, rising interest rates and bloated channel inventories have dented the PC market’s momentum, and are likely to persist into 2023,” the report indicated.

In particular, notebook shipments suffered the most, posting a year-on-year decline of 19% with 54.7 million units shipped. Desktop shipments proved more robust due to less reliance on consumer spending, falling 11% year-on-year for a total of 14.7 million units. According to Canalys senior analyst Ishan Dutt, “Following a slowdown in the first half of the year, the PC market has now posted a record year-on-year decline.”

“While the Q3 shipment volume remains comparable to pre-pandemic figures, the rapid deterioration in demand across all segments is a worrying sign not only for vendors, but for stakeholders across the supply chain. Intel and AMD are facing headwinds from weakness in their PC businesses, and smaller makers of components from ICs to memory are cutting production and lowering earnings forecasts,” he added.

After Samsung announced its preliminary results, PC-processor maker AMD also said it will miss its earlier forecast by about US$1 billion. Bloomberg, in a recent report, quoted Benstein’s senior semiconductor analyst Stacy Rasgon, who reckons “end demand has likely deteriorated markedly in recent weeks, and end customers appear to be aggressively draining inventory.”He even sees the cut in AMD’s client-revenue “is admittedly a bit breathtaking.”

To recall, the numbers by Samsung, AMD and even Canalys, came a while after grim comments from memory makers Micron Technologies Inc. and Kioxia Holdings Corp., which have slashed spending and output in a bid to stabilize plummeting prices.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network