Samsung lost its grip on the semiconductor market most of this year. Is the worst over? (Photo by Jung Yeon-je / AFP)

Samsung lost its grip on the semiconductor market most of this year. Is the worst over?

- Samsung reported losses of 4.58 trillion won and 4.36 trillion in its semiconductor business for the first and second quarters, respectively.

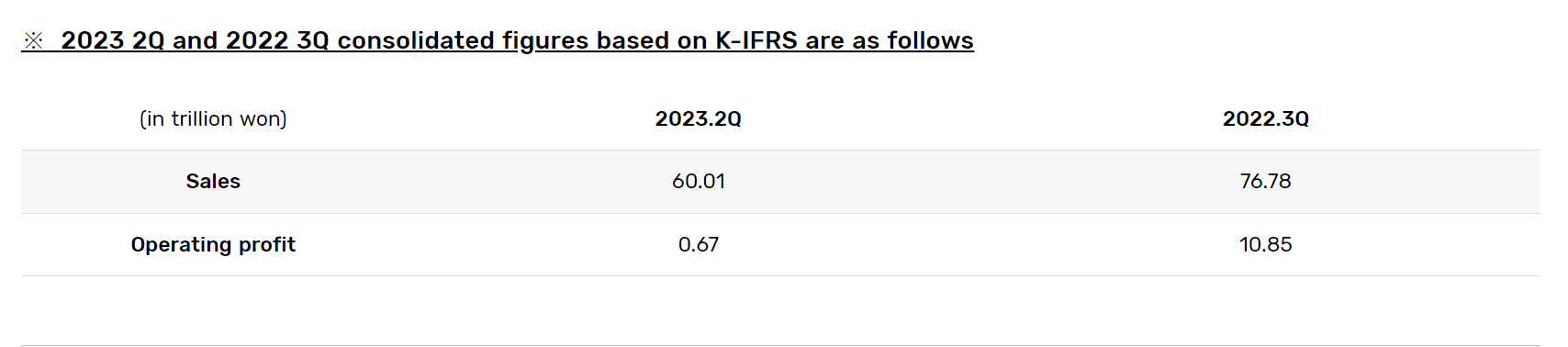

- Samsung’s profits plunged 78% in the third quarter, which was still itsbest quarterly profit this year.

- Samsung supplying advanced memory chips for Nvidia’s AI-focused GPUs could significantly boost the company in the coming quarters.

Samsung Electronics, the world’s largest memory chip and smartphone maker, has witnessed its most significant profit-driving segment — semiconductors — under pressure for most of this year. So much so that the South Korean giant reported losses of 4.58 trillion won and 4.36 trillion in its semiconductor business for the first and second quarters of this year, respectively.

For its recently-concluded third quarter, Samsung’s usually lucrative semiconductor division is anticipated to report an over 3 trillion won loss, lower than previous quarters. The better-than-expected numbers, however, still signal persistent challenges within the chip market. For starters, memory chip prices have experienced a substantial decline throughout the year, primarily due to oversupply and reduced demand for devices like smartphones and laptops.

The downturn has significantly impacted Samsung’s profitability. In its previous earnings report from July, the company had forecasted an uptick in chip demand during the year’s second half. Still, this resurgence seems to be unfolding more slowly than was initially anticipated. To address this issue, the tech giant has reduced its chip production, although the impact of this measure is unlikely to be reflected in the third-quarter results.

Samsung issued preliminary Q3 results. Here’s what they show

Samsung issued earnings guidance this week. As anticipated by the company, there was a more modest slide in quarterly profit after staunching losses at its semiconductor division all year. A Bloomberg report indicated that the 78% decline in operating income was better than what most analysts had feared.

Experts believe that memory chip prices have likely bottomed in the third quarter, with some types starting to rebound. According to Samsung’s preliminary results, the world’s largest memory chipmaker estimated its operating profit fell to 2.4 trillion won (US$1.79 billion) in July-September, on a 13% slide in sales. The numbers reflect an improvement from the record 95% year-on-year plunge in the previous quarter.

Samsung Electronics announced its earnings guidance for the third quarter of 2023 this week. Source: Samsung

Analysts polled by LSEG expect an operating profit of 2.3 trillion Korean won (US$1.7 billion) for the September quarter, a 78.7% year-on-year (YoY) decline. Revenue is expected to come in at 67.8 trillion won, a fall of 11.6%, according to LSEG consensus forecasts. Samsung will give a more comprehensive snapshot of its earnings later this month.

A report by CNBC has indicated that there could be two possible bright spots for Samsung that could lead to better growth in the September quarter. First, its display division could experience an increase in sales compared to the previous quarter, thanks to the launch of Apple’s iPhone 15 series, for which Samsung supplies displays. And second, Samsung’s smartphone segment could witness enhanced profit margins, driven by the high-end foldable phones introduced in July.

Down 80% – but still better than expected?

In a less-than-ideal outcome, Daiwa Capital Markets said in a note earlier this month that it expects Samsung’s earnings to miss consensus estimates “due to the higher cost burden from the memory production cut and ongoing soft demand” for its semiconductor manufacturing unit, known as the foundry business. Daiwa analyst SK Kim sees operating profit for the third quarter at 1.65 trillion won, much lower than the average analyst estimate of 2.3 trillion won.

But Kim forecasts the inventory glut easing and memory prices rising in the fourth quarter. Separately, a Citi note in August suggested that Samsung will begin supplying advanced memory chips for US semiconductor giant Nvidia’s graphics processing units, which are used for AI. Kim believes that will be a boost for Samsung, adding: “We expect growing opportunities related to AI demand in 2024.”

Terrible two: Samsung semiconductor and smartphone market slump

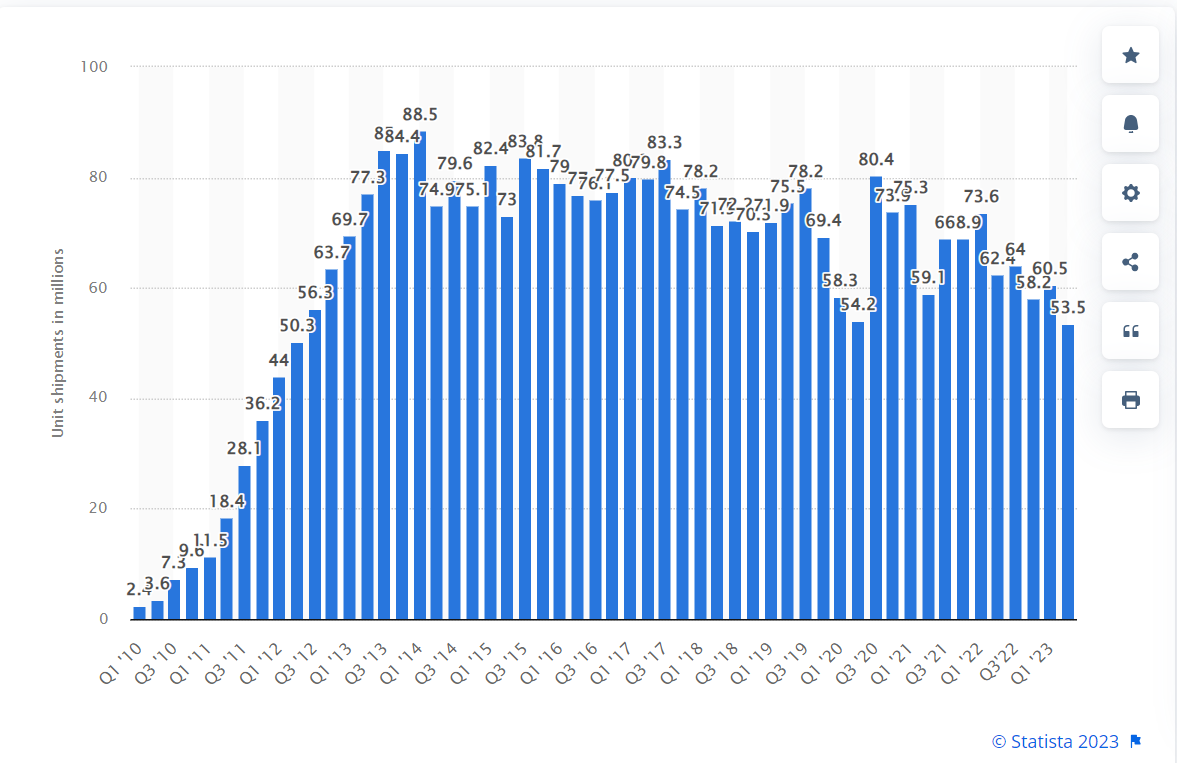

Global smartphone unit shipments of Samsung 2010-2023, by quarter. Source: Statista

The global smartphone market has been in a slump for the past two years, and the first half of 2023 saw the most significant shipments drop in years. Most smartphone players, including Samsung and Apple, continued recording dips in their loads. But it has been worse for Samsung, which saw a more significant drop.

Data from CasinosEnLigne.com shows Samsung shipped 114 million smartphones in the year’s first half, a 16% drop from the 136 million reported in the first half of last year. Overall, global shipments of smartphones are expected to decline by 3.2% in 2023, according to a forecast from International Data Corporation’s Worldwide Quarterly Mobile Phone Tracker.

Recovery is only anticipated from 2024 onward.

A better-than expected result, but still a significant profit plunge for Samsung.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network