Shein and Temu vie for the same US customers, emphasizing apparel and aiming to be a comprehensive platform akin to Amazon. (Photo by Stefani Reynolds / AFP).

Temu is paying a hefty price to rival Shein, Amazon, and TikTok Shop this holiday season

- Shein and Temu vie for the same US customers, emphasizing apparel and aiming to be a comprehensive platform akin to Amazon.

- Despite rapid growth, Temu faces challenges in warehouse capacity and order fulfillment. Temu is also grappling with significant financial losses.

- Concerns are looming about the company’s ability to turn a profit despite its substantial user base.

Around 14 months ago, Temu was launched in the US as a rival to Shein, a Chinese fast-fashion giant dominating the global e-commerce market. Temu is owned by PDD Holdings, which also owns Pinduoduo, a Chinese online shopping app popular in China for its low prices and gamified features. Temu uses similar tactics, and the American market was its first major overseas push.

A rapid expansion followed; today, Temu is available in 23 countries. By October 17, 2022, about one month after its launch, Temu became the most downloaded shopping app in the US. It was a notable feat for Temu to outperform Amazon, Walmart, and Shein shortly after entering a new market. The app debuted in the Japanese market in July and expanded to the Middle East through Israel and Southeast Asia via the Philippines in August.

Temu’s app performance in 2023

By November this year, Temu had achieved 250 million downloads, as reported by Business of Apps. Today, Temu stands as the second most popular e-commerce app in the US, behind only Amazon Shopper, according to Similarweb estimates of monthly active users for iOS and Android combined. Temu is the tenth most popular app, trailing only apps operated by tech giants like Google and Meta-owned platforms.

Data from Similarweb shows that US web traffic to temu.com is up more than 1,000% year-over-year (YoY), reaching nearly 99 million visits per month as of September. Temu’s web traffic reached over 326 million trips globally, up more than 4,000% YoY.

As for conversion rate – the percentage of website visitors who make a purchase – Temu’s was at 4.6% in September this year, a little less than that of Shein (4.7%) but better than Forever 21 (3.6%) and ASOS (3.3%). No one, however, comes close to Amazon (11.8%).

The sky-high spending by Temu to compete with Shein, Amazon, and TikTok Shop

Temu employs a strategy akin to Shein’s, providing substantial discounts through coupons, subsidies and considerable advertising spending. This approach generates favorable outcomes, at least in the immediate term, but may not be sustainable in many ways to compete with the likes of Amazon.

Source: Shutterstock

According to Meta, Temu has run over 50,000 global ads on its platforms this month alone, with posts in English and Chinese. However, its swift expansion has come with challenges. Sellers report that Temu is grappling with a logistics nightmare: limited warehouse capacity as it strives to fulfill orders and manage returns.

As reported by business news site 36kr, the company had reached its storage limit in March, particularly after a surge in orders following its Super Bowl advertisement. Some sellers on the platform have encountered challenges shipping their products due to limited space at Temu’s premises.

To top it off, the company is still operating at a significant financial loss. As per the Chinese news outlet 36kr, Temu faces a loss of approximately 30-35% on each US order and an average of 40% on global rankings. Initially budgeting a net loss of 20 billion renminbi (US$2.76 billion) for 2023, the company has revised this figure to 23 billion renminbi (US$3.17 billion), as per 36kr.

Adding to that, Temu has invested substantial amounts to reach American consumers alone, according to various reports. In February 2023, the company reportedly spent US$14 million on two 30-second slots during Super Bowl LVII. Additionally, it allocates up to US$10 million daily for advertisements on Meta and Google, as per an analysis of Tencent.

The company is capitalizing on the “trading down” trend in American shopping, where consumers while maintaining spending habits, opt for value in lower-priced categories. A McKinsey Consumer Pulse Survey from April reported that 80% of respondents had altered their shopping behavior by trading down.

But by the time Temu reached its first year of operations in the US, its rivalry with Shein had intensified, with the entry of TikTok Shop–also selling Chinese goods to the US and beyond. Shortly before that, in May, WIRED reported that Temu had broadened its demographic appeal, targeting buyers from higher-income segments and aiming to boost average order sizes, which stood at around US$25 then.

The battle for sub-Amazonian supremacy continues.

Increasing order sizes is a strategy to improve the company’s chances of breaking even. After all, a considerable portion of Temu’s expenses is attributed to international shipping, as the company emphasizes free delivery on nearly all items as a key selling point. A source confirmed to WIRED that the average order size in the US has increased to US$37 as of November, although Temu did not provide an official comment on this figure.

WIRED’s analysis earlier this year also shows that Temu incurs approximately US$10 in shipping and handling expenses per package. This includes US$1 for moving items from sellers to warehouses in China and US$5 for shipping from those warehouses to foreign countries. “Analysts anticipate that this cost is likely to rise,” an article from WIRED reads.

Gearing up for the holiday season sale

The immense scope of Black Friday positions it as a battleground for intense competition among e-commerce brands. Deloitte forecasts a 10.3 to 12.8% growth in e-commerce sales during the 2023-2024 US holiday season, potentially reaching US$284 billion.

In 2022, Temu made a splash with Black Friday deals, including a 30% discount on users’ initial orders, catapulting it to the summit of Apple’s App Store. According to discussions obtained by WIRED from a Temu seller WeChat group, the platform has been strategically laying the groundwork for this year’s year-end sales since August. It has been recruiting sellers in China to prepare Christmas gifts and decorations.

According to WIRED, the company even conducted a conference on November 9 to help sellers in gearing up and planning for the approaching Black Friday and Christmas season. What remains a harsh truth is that although Temu and Shein are offering deals for cheap goods for the holiday shopping season, in terms of turning visits into actual sales, they still far lag behind market leader Amazon.com.

In October, Shein’s website attracted 28.6 million unique monthly visitors, marking a 7.25% increase from the previous year, as reported by Similarweb. But the conversion rate from website visits to actual transactions declined from 4.6% to 4.1% YoY. Meanwhile, Temu experienced substantial growth, reaching 42 million unique monthly visitors in October 2023, quadrupling its numbers from the previous year.

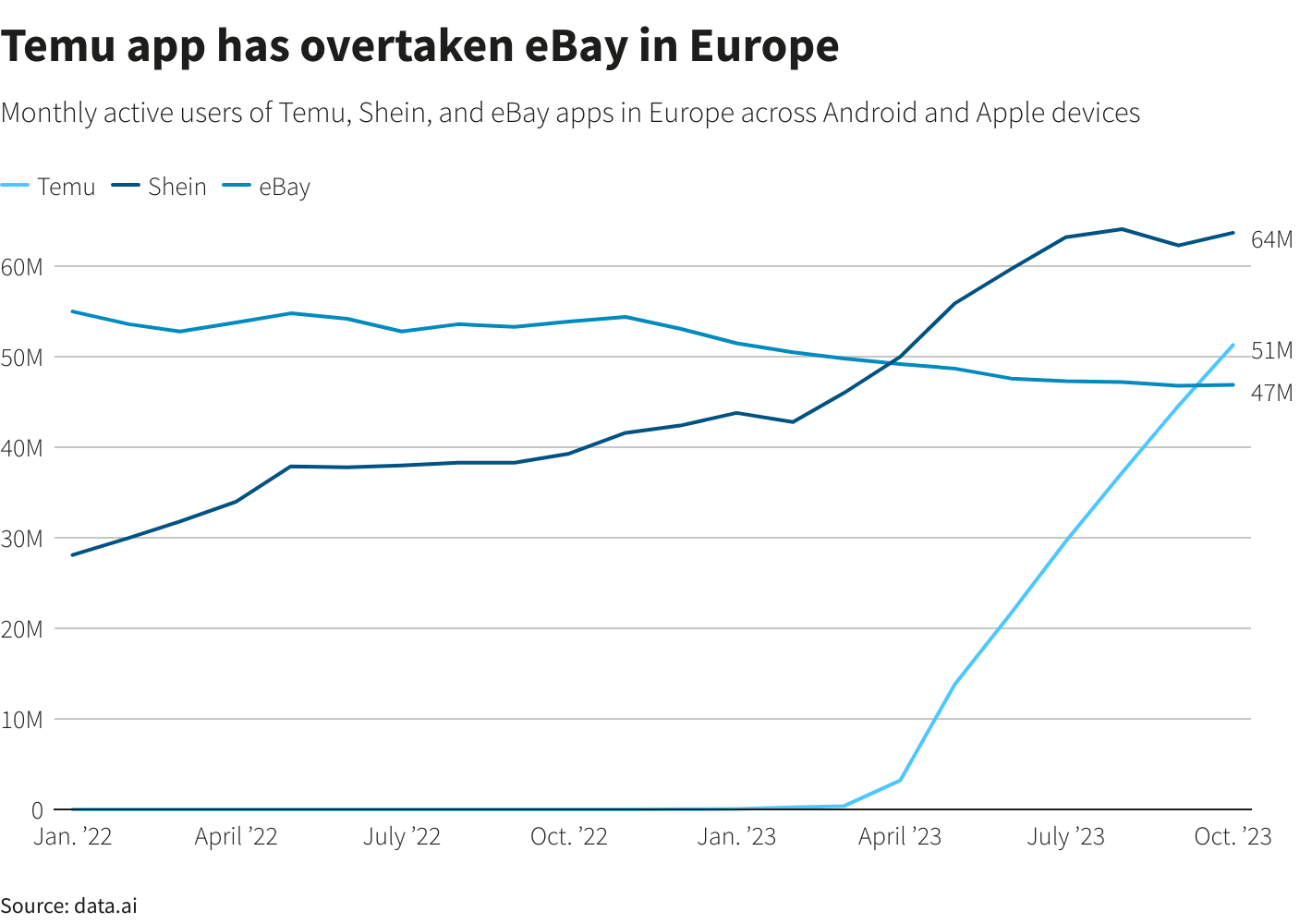

Nevertheless, only 4.5% of these visits translated into actual transactions. On the other hand, Amazon outperforms both online retailers, as its data reveals that 56% of its 268 million unique monthly visits in October resulted in purchases. But the Temu app overtook eBay in Europe in October, hitting 51 million monthly active users across Android and Apple devices, according to data.ai.

It will clearly take a lot for Temu to outperform Amazon, but the chances of it catching Shein are much higher. It looks set to maintain its dominance in higher-value transactions, but is expected to face growing competition in the space of more affordable items.

In Europe, the Temu app overtook eBay. Source: Data.ai

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network