Will TikTok Shop reign supreme in Southeast Asia? (Image – Shutterstock)

TikTok Shop looking to reign over e-commerce platforms in Southeast Asia

- TikTok Shop is Southeast Asia’s fastest-growing e-commerce platform.

- Sales on TikTok are also boosted by the creation of viral products.

- E-commerce platforms like Shopee and Lazada hope to boost their sales.

E-commerce platforms in Southeast Asia have experienced continued success due to changing shopping habits in the region. Even before the COVID-19 pandemic, these platforms were growing steadily, offering a wide range of products and streamlining the shopping experience.

The e-commerce industry in Southeast Asia is among the fastest-growing, globally. According to a Momentum Works report, the total GMV of Southeast Asia’s nine top e-commerce platforms hit US$99.5 billion in 2022, almost a twofold increase from 2020, the pandemic’s initial year. This report forecasts the region’s total GMV to reach US$175 billion by 2028.

While Lazada, Shopee, and Tokopedia are among the region’s most successful e-commerce platforms, TikTok Shop has been rapidly climbing the ranks, capturing a significant market share since it began operations around three years ago.

In fact, in less than three years since its debut, TikTok Shop has emerged as a significant e-commerce player in Southeast Asia, achieving a US$4.4 billion GMV in 2022. By 2023, TikTok Shop’s projected market share in Southeast Asia is expected to be 13.2%, putting it in the same tier as stalwarts like Lazada and Tokopedia.

Insights from Momentum Works’ report, The TikTok Shop Playbook: How ecosystem stakeholders should respond to the e-commerce insurgent, also indicate that the e-commerce platform has the strongest growth in Southeast Asia, despite expanding into the United Kingdom, Saudi Arabia and the United States.

“Ultimately, change is the only constant. Whether TikTok Shop is a threat to incumbent platforms might not be a standalone question at all. The bigger narrative is that in e-commerce platforms, where leading players seem to have a network effect and structural advantage, disruption can still happen and the incumbents should always remain focused and vigilant,” said Weihan Chen, Insights Lead at Momentum Works.

TikTok Shop is the fastest growing e-commerce platform in Southeast Asia. (Image – Shutterstock)

The rise of TikTok Shop

TikTok Shop’s e-commerce modus operandi is very similar to that of several other e-commerce platforms in the region. However, what gives the app a huge advantage is its users. TikTok is already one of the biggest and most popular social media apps in the world. Despite calls for a ban by some governments, the app continues to grow its user base.

With over a billion active users in Southeast Asia, TikTok already enjoys substantial natural traffic, saving on acquisition and retention costs. The platform operates based on recommendations rather than searches, allowing products to be tailored to user preferences.

TikTok Shop launched in Singapore around a year ago. During the launch, Ng Chew Wee, Head of Business Marketing, APAC at TikTok said that Singapore had exceeded its potential as a major e-commerce market, with its projected market volume expected to hit US$11.45 billion by 2025. Ng added that TikTok Shop presents the ultimate convergence of content and commerce, with unique shoppertainment experiences for all.

“In this way, TikTok Shop not only empowers local businesses to effectively tap into the platform’s fast-growing audience base to drive tangible business results, but also affords the delivery of content that delights and entertains – resonating with the right audience across the discovery to purchase stages,” she said.

Since the launch in Singapore, the app’s revenue has only continued to grow. Being a content-driven platform, TikTok also has access to content-handling parties like creators and MCNs playing key roles in the ecosystem. This is where the app picked up its shoppertainment offerings. Unlike other social media platforms, ByteDance, the parent company of TikTok, was quick to use the platform for e-commerce through shoppertainment.

Another TikTok Shop to visit…

Shoppertainment is the use of videos to drive sales for a particular product or brand. Normally live-streamed, e-commerce platforms like Shopee have also been using the method to increase sales.

In shoppertainment, a seller broadcasts themselves live on the platform. Some sellers perform demonstrations with the products, while others just talk about the product. The products are sold live on air. Users can purchase them via the app or even bid for them if it’s a limited edition or special product.

While Shopee has initially been successful with this, the app now finds itself competing with TikTok Shop. According to the report, the best-selling categories on TikTok Shop currently are beauty and personal care products, which account for 84% of the units sold and 70% of the GMV. Four out of five top-selling items also come from these categories, where sellers create bundles to increase average order value.

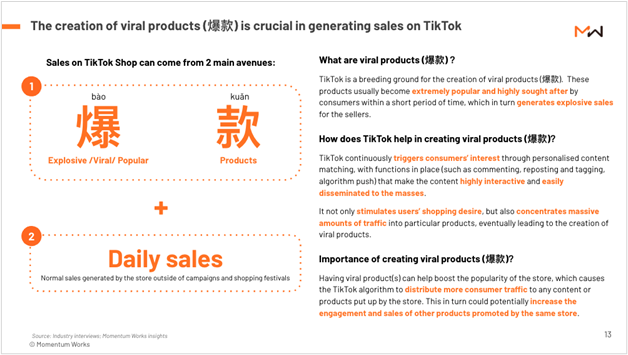

Apart from these, TikTok also gets its sales from the creation of viral products. TikTok Shop does this by triggering consumer interest continuously. This includes using personalized content-matching functions such as commenting, reposting, tagging and algorithm push. The diagram below shows how exactly TikTok Shop does it.

Here’s how TikTok Shop gets it sales. (Source – Momentum Works)

Over in China, TikTok’s sister company Douyin has disrupted the Chinese e-commerce market as well. The app is competing mainly with Pinduoduo, slashing Alibaba’s market share from more than 80% to less than 50% within six years. Globally, TikTok Shop is becoming a threat to incumbent e-commerce marketplaces, including Amazon in the US and the Middle East.

Unfortunately, while TikTok Shop launched in the US last year, restrictions on TikTok mean there is a limit to exactly what the app can sell. According to reports, TikTok also limited the US version of Shop to sellers who are US residents or businesses registered in the US, which means the overseas merchants that account for a large share of sellers on Amazon, Walmart, and other platforms can’t sell on the platform.

The report also highlights the fact that the US market could potentially be much bigger for TikTok Shop in the future – and could help TikTok unlock greater commercial opportunities than all of the Southeast Asian markets combined, if TikTok plays its cards right.

TikTok Shop’s live streaming capabilities are popular among sellers. (Image – Shutterstock)

The state of e-commerce platforms in Southeast Asia

TikTok Shop’s growth in the region has definitely caused a ripple effect among e-commerce platforms as well. Most of these platforms are aware of the potential challenge that is coming their way.

Apart from TikTok Shop, Tech Wire Asia took a look at five of Southeast Asia’s e-commerce platforms and how they could retain their market dominance.

Shopee – Shopee currently has the largest GMV in Southeast Asia, at 46.5%. However, its share has dropped since 2022. Shoppertainment remains a unique selling feature in the e-commerce app. The e-commerce platform has also ventured into other areas beyond e-commerce. These include providing financial services to some users, through its BNPL offerings and others, something which TikTok shop has yet to venture in. The app has also ventured into the food delivery industry market, but remains focused on its e-commerce sector.

Lazada – Considered one of the pioneers of mobile e-commerce, Lazada’s GMV in the region has also shrunk in 2023 due to TikTok Shop’s growth. Lazada remains purely focused on e-commerce. Its parent company, Alibaba Group, recently announced plans to invest an additional US$845 million into the e-commerce platform, with plans for more expansion. Lazada also recently unveiled LazzieChat, a generative AI chatbot, into its platform.

Tokopedia – Once the e-commerce giant of Indonesia, the e-commerce arm of GoTo is facing slower growth following a series of layoffs and cost-cutting measures to become profitable. The app also now finds itself competing directly with TikTok Shop, which is becoming a hot favorite among Indonesian buyers and sellers. Despite launching some new features for customers, Tokopedia may just have to find more ways to rebuild its reputation as a top e-commerce platform in Indonesia.

Shein – Starting out as a fast-fashion brand that launched during the COVID-19 pandemic, Shein is also growing in popularity in Southeast Asia. Its focus is primarily on fashion, from clothing to accessories. While the e-commerce app may not be the fastest-growing app in Southeast Asia, it seems to be picking up more customers in other parts of the world. The app is already the most downloaded in South Africa and is the fastest-growing e-commerce shopping app in the US.

Bukalapak – Another Indonesia e-commerce platform, Bukalapak is probably struggling the most out of the examples mentioned. A fresh round of layoffs, including those in its production and engineering team, as well as a US$26 million net loss in the first half of the year indicate that the app is definitely in need of some rejuvenation. Nevertheless, the app is confident of delivering profits by the fourth quarter of 2023.

While there are several other e-commerce platforms in the region, these companies make up a bulk of the market share. TikTok Shop just needs to continue to play its cards right and it could take a bigger market share by the end of the year. Its success in the region is due to its ability to provide customers with a seamless e-commerce experience, as well as making the most of its user base with the right tools.

Here’s a video that explains it all.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network