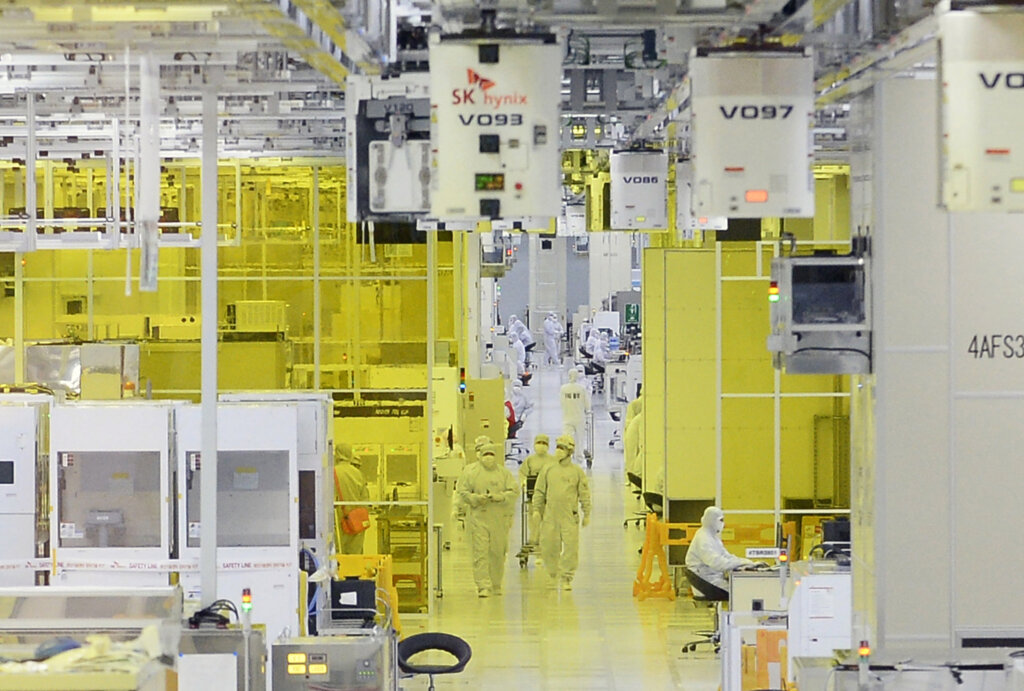

Samsung and SK Hynix will lead a US$470 billion initiative to establish the world’s largest chip-making cluster, fortifying South Korea’s position in the global semiconductor race. (Photo by JUNG Yeon-je/AFP).

World’s largest chipmaking hub to be backed by Samsung and SK Hynix

- Samsung and SK Hynix will lead a US$470 billion initiative to establish the world’s largest chipmaking cluster, fortifying South Korea’s position in the global semiconductor race.

- The blueprint entails a private sector investment of 622 trillion won, funding 13 new chip plants and three research facilities.

- Samsung and Hynix will construct their cutting-edge chip plants domestically as part of the two-decade strategy.

Nestled in the technological crucible of East Asia, South Korea’s semiconductor industry stands as a pulsating nerve center of innovation and industrial prowess. With giants like Samsung Electronics Co. and SK Hynix Inc. leading the charge, South Korea has scripted a tale of innovation, investment, and a relentless pursuit of global dominance. In a recent revelation, South Korea unveiled plans to invest over US$470 billion, marking a historic move to establish the world’s largest chip-making cluster.

This ambitious endeavor encompasses a two-decade strategy, and the stakes are high. On Monday, the government delineated a roadmap for an investment totaling 622 trillion won (US$471 billion) in collaboration with private sector powerhouses, spanning the years until 2047. The plan envisions a landscape brimming with 13 state-of-the-art chip plants and three cutting-edge research facilities, supplementing 21 fabs.

“As revealed by the Ministry of Trade, Industry, and Energy in South Korea, Samsung Electronics, SK Hynix, and other semiconductor companies are set to pool their resources into building 16 new fabs, with the potential to generate over 3 million job opportunities,” a report by TrendForce reads.

Stretching across the dynamic regions of Pyeongtaek to Yongin, South Korea’s chipmaking cluster is poised to be the largest on the planet. By 2030, the new mega chip cluster, spanning a massive 2,102 square meters, aims to churn out a staggering 7.7 million wafers monthly, setting new benchmarks in semiconductor production. The linchpins of this grand venture are Samsung and SK Hynix, each charting its unique course in the chip-making saga.

South Korea’s national flag (R) and the Samsung Electronics flag flutter at the company’s headquarters in Suwon on June 13, 2023. (Photo by Jung Yeon-je/AFP).

Samsung, a global tech behemoth, is embarking on a bold foray into foundry services. With a colossal investment of 500 trillion won, Samsung seeks to redefine the landscape by manufacturing chips for other firms, cementing its status as a formidable player in the semiconductor ecosystem.

“Within this sprawling cluster, Samsung Electronics has outlined plans to construct six new fabs at the national industrial complex in Yongin, with an investment commitment of 360 trillion Korean won. Additionally, the company intends to establish three fabs in Pyeongtaek, involving an investment of 120 trillion Korean won, and three research fabs at an R&D center located in the Giheung District, for 20 trillion Korean won,” TrendForce added.

On the other end of the spectrum, SK Hynix focuses on memory. Investing 122 trillion won in Yongin, SK Hynix aims to construct four sophisticated chip plants, laying the foundation for South Korea’s prominence in-memory technology in Yongin. According to the government, the primary objective of this supercluster is to foster an environment conducive to the production of cutting-edge memory chips, including high bandwidth memory (HBM) and system semiconductors measuring 2 nanometers or more advanced nodes,”

Overall, the foresighted investment represents a substantial increase from the unveiling of Samsung’s and Hynix’s plans in 2023. South Korea’s government, working hand-in-hand with private enterprises for national interests, has been amplifying its support for a domestic chip sector that constitutes approximately 16% of total exports.

Workers are seen on the operations floor of an SK Hynix plant in Icheon on August 25, 2015. South Korea’s SK Hynix Inc., the world’s second-largest memory chip maker, announced August 25 it would spend 46 trillion won (US$38 billion) in facility investments over the next 10 years. AFP PHOTO/POOL/KIM MIN-HEE (Photo by KIM MIN-HEE/POOL/AFP).

In the face of escalating global competition, especially from Japan and Taiwan, which are aggressively bolstering their chip sectors, the Korean government is committed to providing significant tax incentives for local chip firms. The region is poised to host major players and smaller chip design and materials companies.

The strategic move isn’t just about economic prowess; it’s a calculated step in securing South Korea’s future as a paramount force in global chipmaking. The overarching aspiration is to enhance the nation’s self-sufficiency in semiconductors while targeting a market share of 10% in global logic chip production by 2030, a significant leap from the current 3%.

READ MORE

- Data Strategies That Dictate Legacy Overhaul Methods for Established Banks

- Securing Data: A Guide to Navigating Australian Privacy Regulations

- Ethical Threads: Transforming Fashion with Trust and Transparency

- Top 5 Drivers Shaping IT Budgets This Financial Year

- Beyond Connectivity: How Wireless Site Surveys Enhance Tomorrow’s Business Network